3d Printing Market Growth Analysis, Opportunities And Forecast Report 2024 - 2030

The global 3D printing market size is expected to reach USD 88,281.2 million by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 23.5% from 2024 to 2030. 3D Printing (3DP) is also referred to as Additive Manufacturing (AM) as it involves successive addition of layers of materials in various 2D shapes using an additive process. These layered 2D shapes build upon one another to form a three-dimensional object. The process is different from the subtractive method of production, which begins with a block of material and the unnecessary material is ground out to obtain the desired object.

3D printing is widely adopted in the industrial sector owing to the growing need for enhanced product manufacturing and a shorter time to market. The industrial vertical happens to be the most significant adopter of the 3D printing technology, eventually leading to the largest market share of 3D printers for industrial applications over the forecast period. Additive manufacturing is anticipated to evolve over the forecast period.

Gather more insights about the market drivers, restrains and growth of the 3d Printing Market

Detailed Segmentation:

Market Concentration & Characteristics

The 3D Printing Market growth stage is high. The 3D printing market has witnessed a significant degree of innovation, marked by continuous advancements in 3D printing materials market, printing technologies, and the expansion of applications across diverse industries. Ongoing research and development efforts have led to the introduction of more sophisticated and efficient 3D printers, enabling the production of complex and functional objects with improved speed and precision. The dynamic landscape reflects a continuous quest for innovation, with 3D printing increasingly positioned as a transformative technology driving advancements in manufacturing and design processes.

Printer Type Insights

The industrial printer segment led the market and accounted for more than 76.0% share of the global revenue in 2023. Based on the printer type, the industry has been further segmented into industrial and desktop 3D printers. The large share of industrial 3D printers can be attributed to the extensive adoption of industrial printers in heavy industries, such as automotive, electronics, aerospace and defense, and healthcare. Prototyping, designing, and tooling are some of the most common industrial applications across these industry verticals.

Technology Insights

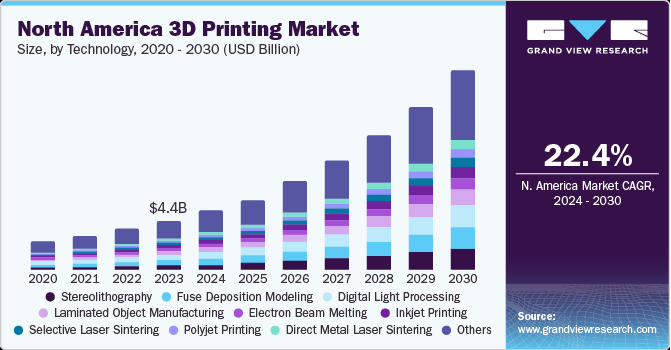

The stereolithography segment led the market and accounted for more than a 10.0% share of the global revenue in 2023. Based on technology, segmentation has been divided into stereolithography, fuse deposition modeling (FDM), direct metal laser sintering (DMLS), selective laser sintering (SLS), inkjet, polyjet, laser metal deposition, electron beam melting (EBM), digital light processing, laminated object manufacturing, and others.

Software Insight

The design software segment led the market and accounted for more than 36% share of the global revenue in 2023. It is expected to continue dominating the market during the forecast period. Based on software, the 3DP industry has been segmented into design software, inspection software, printer software, and scanning software. Design software is used for constructing the designs of the object to be printed, particularly in automotive, aerospace and defense, and construction and engineering verticals. Design software acts as a bridge between the objects to be printed and the printer’s hardware.

Application Insight

The prototyping segment led the market and accounted for more than 54% share of the global revenue in 2023. Based on application, the industry has been segmented further into prototyping, tooling, and functional parts. Prototyping segment accounted for the largest share in 2023 owing to an extensive adoption of the prototyping process across several industry verticals. The automotive, aerospace and defense verticals mainly use prototyping to design and develop parts, components, and complex systems precisely.

Vertical Insight

The automotive segment led the market and accounted for more than 23% share of the global revenue in 2023. Based on vertical, the industry has been segmented into separate verticals for desktop and industrial 3D printing. The verticals considered for desktop 3DP comprise educational purposes, fashion, jewelry, objects, dental, food, and others. The verticals considered for industrial 3DP comprise automotive, aerospace and defense, healthcare, consumer electronics, industrial, power and energy, and others.

Material Insight

The metal segment led the market for 3D printing and accounted for more than 54% share of the global revenue in 2023. Moreover, the metal segment is anticipated to maintain its lead during the forecast period and is expected to expand at the highest CAGR during the forecast period. Based on material, the industry has been segmented further into polymer, metal, and ceramic.

Component Insight

The hardware segment led the market and accounted for more than 63% share of the global revenue in 2023. The hardware segment has benefitted significantly from the growing necessity of rapid prototyping and advanced manufacturing practices. The growth of the hardware segment is primarily attributed to various factors such as rapid industrialization, increasing penetration of consumer electronic products, developing civil infrastructure, rapid urbanization, and optimized labor costs.

Regional Insight

North America led the market and accounted for more than 33% share of the global revenue in 2023. This can be attributed to the extensive adoption of additive manufacturing in the region. North American countries, such as the U.S. and Canada, have been among the prominent and early adopters of these technologies in various manufacturing processes. Europe happens to be the largest region in terms of its geographical footprint. It is home to several additive manufacturing industry players with strong technical expertise in additive manufacturing processes. Hence, the European market emerged as the second-largest regional market in 2023.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global accelerated processing unit market size was estimated at USD 13.85 billion in 2023 and is projected to grow at a CAGR of 17.5% from 2024 to 2030.

• The global centralized refrigeration systems market size was estimated at USD 29.87 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030.

Key Companies & Market Share Insights

Some of the key players operating in the market include 3D Systems, Inc. and Materialise among others.

• 3D Systems, Inc. is the U.S.-based technology company. The company is involved in the development of Desktop 3D printing products and services such as 3D printers, materials, software, 3D scanners and virtual surgical simulators and haptic design tools. Additionally, the company serves its customers with 3D solutions to manufacture and design complex and unique parts, produce parts locally to reduce the lead time, and eliminate expensive tooling, among others. The company caters to numerous industries and verticals such as aerospace & defense, automotive, healthcare, educational, durable goods, and entertainment.

• Materialise is a Belgium-based technology company operating in the additive manufacturing industry. The company is actively involved in the field of Desktop 3D printing to develop a broad range of software solutions, Desktop 3D printing services, and engineering. The company primarily caters to the industries such as healthcare, aerospace, automotive, consumer goods, and art & design.

Key 3D Printing Companies:

• 3D Systems, Inc.

• 3DCeram

• Arcam AB

• Autodesk, Inc.

• Canon, Inc.

• Dassault Systemes

• EnvisionTec, Inc.

• EOS (Electro Optical Systems) GmbH

• ExOne

• GE Additive

• HP Inc.

• madeinspace.us

3D Printing Market Segmentation

Grand View Research has segmented the global 3D printing market based on component, printer type, technology, software, application, vertical, material, and region:

3D Printing Component Outlook (Revenue, USD Million, 2017 - 2030)

• Hardware

• Software

• Services

3D Printing Printer Type Outlook (Revenue, USD Million, 2017 - 2030)

• Desktop 3D Printer

• Industrial 3D Printer

3D Printing Technology Outlook (Revenue, USD Million, 2017 - 2030)

• Stereolithography

• Fuse Deposition Modelling

• Selective Laser Sintering

• Direct Metal Laser Sintering

• Polyjet Printing

• Inkjet printing

• Electron Beam Melting

• Laser Metal Deposition

• Digital Light Processing

• Laminated Object Manufacturing

• Others

3D Printing Software Outlook (Revenue, USD Million, 2017 - 2030)

• Design Software

• Inspection Software

• Printer Software

• Scanning Software

3D Printing Application Outlook (Revenue, USD Million, 2017 - 2030)

• Prototyping

• Tooling

• Functional Parts

3D Printing Vertical Outlook (Revenue, USD Million, 2017 - 2030)

• Industrial 3D Printing

o Automotive

o Aerospace & Defense

o Healthcare

o Consumer Electronics

o Power & Energy

o Others

• Desktop 3D Printing

o Educational Purpose

o Fashion & Jewelry

o Objects

o Dental

o Food

o Others

3D Printing Material Outlook (Revenue, USD Million, 2017 - 2030)

• Polymer

• Metal

• Ceramic

3D Printing Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o U.K.

o Germany

o France

o Italy

o Spain

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

o Singapore

• South America

o Brazil

• Middle East and Africa (MEA)

o KSA

o UAE

o South Africa

Order a free sample PDF of the 3d Printing Market Intelligence Study, published by Grand View Research.

Recent Developments

• In March 2023, 3D Systems, Inc. announced the launch of NextDent Cast and NextDent Base, two new printing materials, and NextDent LCD1, a printing platform. The materials are designed to enhance material properties, and the printing platform is an easy-to-use small-format printer. With these launches, the company aimed to aid its customers in accelerating additive manufacturing adoption.

• In November 2023, Autodesk Inc. announced the launch of Autodesk AI. This new technology is available in Autodesk products and is designed to provide customers with generative capabilities and intelligent assistance. With the launch of this new technology in Autodesk products, the company aimed to minimize errors by automating repetitive tasks and the needs of its customers.

• In February 2022, Dassault Systèmes has announced a strategic partnership with Cadence Design Systems, Inc. to provide integrated solutions for the development of high-performance electronic systems to enterprise customers in a variety of vertical markets, such as high tech, industrial equipment, and transportation and mobility, aerospace and defense, and healthcare.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology