The global masterbatch market size is expected to reach USD 9.65 billion by 2030 to expand at a CAGR of 6.3% from 2024 to 2030 as per the new report by Grand View Research, Inc. Increasing replacement of metal with plastic is projected to fuel the market growth. In addition, rising demand from the European region is expected to propel the demand over the forecast period.

In terms of revenue, black masterbatch was the largest type segment in 2022 and the trend is anticipated to continue over the forecast period. The increasing need for improving the surface appearance of plastic components in automotive and transportation, building and construction, and consumer goods is expected to contribute to the growth. Additive masterbatch is being widely used on account of various properties it imparts to plastics such as antistatic, antifoaming, antioxidant, antimicrobial, thermo-stabilizer, barrier properties, metal deactivators, anti-block, flame retardant, UV stabilizer, oxygen scavenger, and abrasion resistance. The growth of the packaging sector, especially plastic packaging, is anticipated to drive the demand.

These are used in various end-use industries, such as packaging, building and construction, consumer goods, automotive and transportation, and agriculture, as it imparts useful functional properties such as smooth surface finish and desired hardness. The increasing spending capability of customers toward purchasing attractively packaged consumer goods is expected to trigger the need for various plastic componentss to improve the appearance and other properties. These factors together are anticipated to boost the market demand over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Masterbatch Market

Detailed Segmentation:

Market Concentration & Characteristics

The market is fragmented in nature. The masterbatch is primarily used in the polymer industry for coloring and enhancing the properties of plastics. The global polymer industry is experiencing significant growth, driven by increased demand in various sectors such as packaging, automotive, construction, and consumer goods.

Type Insights

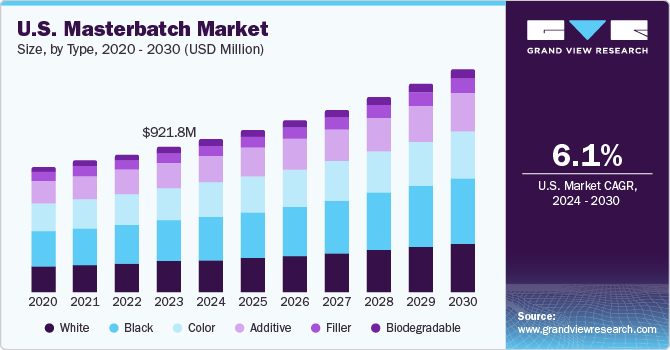

The black type dominated the market with a revenue share of 28.48% in 2023. This high share is attributed to the growth in demand for black masterbatch and the high demand for tires, PVC containers, and other products for application in the automotive and transportation, building and construction, agriculture, and packaging industries. The growing need for agricultural products such as drip irrigation tubing and tape, greenhouse films, shade cloth, and geomembranes is also projected to boost market growth over the forecast period.

Carrier Polymer Insights

The polypropylene (PP) carrier polymer segment dominated the market with a revenue share of 26.68% in 2023. It is attributed to the demand for polypropylene as a carrier polymer is projected to increase owing to its excellent mechanical strength and flexibility offered by it. Polypropylene also enhances the quality of surfaces. It is lightweight and, therefore, is used to replace metal components in the automotive industry. All these factors are expected to fuel the growth of the polypropylene segment in the forecast period.

End-use Insights

The packaging masterbatch end-use segment dominated the market with a revenue share of 26.91% in 2023. Its high share is attributable to the packaging industry, which includes retail, industrial, and consumer packaging, which further includes flexible and rigid options. A rise in the number of city inhabitants who require packaged goods is resulting in an increased demand for packaging. Consumers need packaging that is convenient, sustainable, flexible, offers protection, and is easily traceable. As plastic packing fulfills all these needs, its demand is expected to grow, which is, in turn, projected to result in the growing demand for the product. There is immense growth potential for the packaging industry in emerging economies such as India and China.

Regional Insights

Asia Pacific dominated the market with a revenue share of 30.42% in 2023, owing to the presence of several end-use industries, including automotive and transportation, packaging, building and construction, and consumer goods. The growth of these industries is expected to fuel the demand for the product over the next eight years.

Browse through Grand View Research's Paints, Coatings & Printing Inks Industry Research Reports.

• The global oil and gas corrosion protection market size was valued at 9.78 USD billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 2.4% from 2024 to 2030.

• The global technical textile chemicals market size was valued at USD 8.93 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030.

Key Companies & Market Share Insights

The market is fragmented, with several global and regional players. Key players in the market comply with the regulatory policies and are engaged in research & development activities to develop innovative products. For instance, Hubron International became a corporate member of The Graphene Council, the world’s largest community for graphene researchers, developers, producers, academics, and scientists. Since Hubron International is involved in masterbatch/compounding of graphene materials and has technologies available for the processing of 2D materials, the growing usage of 2D materials in the thermoplastic arena for providing lightweight products is expected to strengthen Hublon International’s position in the masterbatch market. Most key industry players are integrated across the value chain, posing entry barriers for new market players. Some prominent players in the global masterbatch market include:

• In November 2023, The investment firm Koinos Capital, headquartered in Milan, established the Impact Formulators Group by merging the operations of two Italian companies specializing in masterbatch and additives manufacturing, namely Masterbatch S.r.l. and Ultrabatch S.r.l.

• In November 2023, TER Chemicals and Momentive have mutually agreed to extend their current distribution agreement for high-performance additives in polymer modification. This expansion encompasses all European countries, with the exception of Iberia and the UK. The portfolio offered includes multifunctional masterbatches, anti-block agents, light diffusers, crosslinkers, and coupling agents. These products aim to provide customers with effective solutions to enhance the performance of their products and address various processing challenges.

Key Masterbatch Companies:

• A. Schulman, Inc.

• Ampacet Corporation

• Cabot Corporation

• Clariant AG

• Global Colors Group

• Hubron International Ltd.

• Penn Color, Inc.

• Plastiblends India Ltd.

• PolyOne Corporation

• Tosaf Group

Masterbatch Market Segmentation

Grand View Research has segmented the global masterbatch market report based on type, carrier polymer, end-use, and region:

Masterbatch Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• White

• Black

• Color

• Additive

• Filler

• Biodegradable

Masterbatch Carrier Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Polypropylene (PP)

• Polyethylene (PE)

o Low-Density Polyethylene

o High-Density Polyethylene

• Polyvinyl Chloride (PVC)

• Polyethylene Terephthalate (PET)

• PUR

• PS

• Biodegradable Plastics

• Other Carrier Polymers

Masterbatch End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Packaging

• Building & Construction

• Consumer Goods

• Automotive & Transportation

• Agriculture

• Other End-Uses

Masterbatch Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

o Italy

o Spain

o Benelux

o Poland

• Asia Pacific

o China

o India

o Japan

o South Korea

o Taiwan

o Australia & New Zealand

o Indonesia

• Central & South America

o Brazil

o Argentina

o Chile

• Middle East & Africa

o Iran

o Saudi Arabia

o South Africa

Order a free sample PDF of the Masterbatch Market Intelligence Study, published by Grand View Research.

Recent Developments

• In June 2023, Ampacet announced the launch of PET UVA, a masterbatch that offers protection to the packaging contents from harmful UV light, thereby keeping the food fresher, extending product shelf life, and limiting waste. The company also offers UVA in PP and PE.

• In June 2023, Ampacet unveiled the introduction of a new additive - AA Scavenger 0846, designed particularly for restricting the acetaldehyde levels in both PET and rPET bottles. This product launch was aimed at supporting the sustainability efforts of the company in the packaging industry by encouraging the use of recycled materials and reducing waste.

• In April 2023, Penn, Color, Inc. announced the commencement of its world-class facility in Rayong Province, Thailand in order to expand its manufacturing capabilities. The objective of this new plant was to enable the company to deliver high-quality colorant & additive masterbatches across the Asia-Pacific market.