The report "Semiconductor Manufacturing Equipment Market by Lithography, Wafer Surface Conditioning, Etching, CMP, Deposition, Wafer Cleaning, Assembly & Packaging, Dicing, Bonding, Metrology, Wafer/IC Testing, Logic, Memory, MPU, Discrete - Global Forecast to 2029" The Semiconductor Manufacturing Equipment market is expected to reach USD 155.09 billion by 2029, up from USD 109.24 billion in 2024, at a CAGR of 7.3% from 2024 to 2029. The rising demand for semiconductor in automotive sector, increasing need for advanced and efficient chips, and expansion of the semiconductor fabrication facilities are some of the major factors contributing to the growth of the semiconductor manufacturing equipment market. Moreover, opportunities such as advancements in packaging technologies and government initiatives for domestic semiconductor industry drive the market growth.

The key advantages of semiconductor manufacturing equipment are precision and high throughput, which enable very small and much more powerful chips at large-scale volume production. They include scalling for growing technologies, contain advanced process control for yield and quality optimization. They offer flexibility to accommodate various chip types, supporting energy efficiency in a bid to even further minimize impacts on the environment and enable using other advanced techniques like 3D stacking.

IDM firms to dominate the supply chain participant segment of the market during the forecast period.

IDM firms will drive the growth of supply chain participant in the semiconductor manufacturing equipment market due to the increasing manufacturing capabilities for high-performance chips, and declining dependency on outside suppliers for better cost efficiency and control. An IDM is a company that has the semiconductor-making processes in-house. This includes all design and manufacturing activities, so they are fully in control of the whole production cycle. An IDM designs, manufactures, and markets their own semiconductor chips. They have their fabrication plants. They own and operate them and have special tools for wafer fabrication, lithography, testing, and packaging. This creates a vertical integration by which IDMs can maintain stiff quality control, maximize the acceleration of innovation cycles, and respond quickly to the market's demands. Integrated device manufacturers have control over their value chains as compared to fabless semiconductor companies.

Deposition to register the highest CAGR in the market during the forecast period.

The deposition equipment is expected to register highest CAGR. Growth in the semiconductor manufacturing equipment market will be advancements in deposition processes, such as CVD, PVD, and ALD, together with the rising demand for high-performance and miniaturized semiconductor devices. The deposition equipment market is driven by the need for advanced nodes, 3D ICs, and advanced packaging solutions, requiring precision in multilayer structures. Continued demand for the new high-performance devices such as Al and 5G, and memory technologies like 3D NAND, supports this market. The emphasis on energy efficiency along with Al and automation integration in the deposition systems are other emerging trends and help optimize process control, yield, and overall efficiency. Such trends are shaping the deposition equipment market as manufacturers seek solutions to support higher complexity, performance, and sustainability in semiconductor devices.

Americas registered the second-highest CAGR during the forecast period.

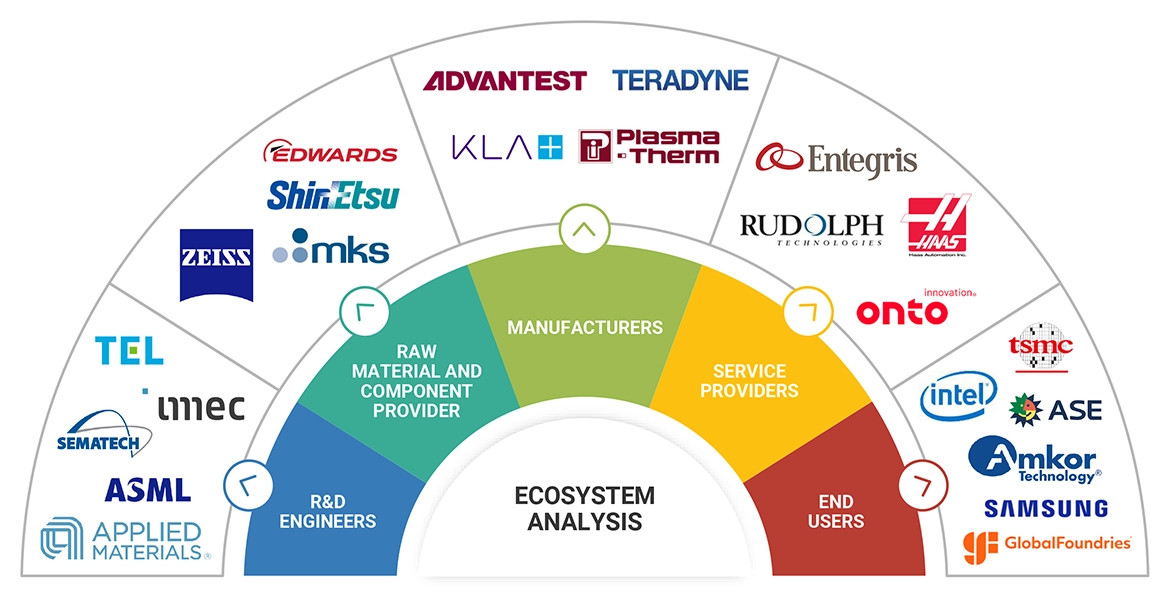

Americas is likely to account for the second-highest CAGR in the semiconductor manufacturing equipment market based on several key factors. The region has strong market presence of leading tech companies and has a robust R&D infrastructure that promotes continuous innovation in the technology for semiconductor manufacturing equipment. Major players-leaders in the market in terms of quality of semiconductor manufacturing equipment-have been Applied Materials, Inc. (US), LAM Research Corporation (US), KLA Corporation (US), Teradyne, Inc. (US), and Plasma-Therm (US). The increased investment in new fabs, adoption of the most advanced manufacturing technologies, such as EUV lithography, and strategic partnerships between semiconductor firms and equipment manufacturers augment growth in the market. These factors combine well to ensure high and immense growth in Americas in the area of semiconductor manufacturing equipment.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263678841

Key players

The report profiles key players such as include Applied Materials, Inc. (US), ASML (Netherlands), Tokyo Electron Limited (Japan), Lam Research Corporation (US), KLA Corporation (US), SCREEN Holdings Co., Ltd. (Japan), Teradyne, Inc. (US), Advantest Corporation (Japan), Hitachi High-Tech Corporation (Japan), and Plasma-Therm (US). These players have adopted various organic and inorganic growth strategies such as product launches, expansions, partnerships, collaborations, acquisitions, and agreements.