Pharmaceutical Packaging Market Business Prospects, Overview And Forecast Report 2024 - 2030

The global pharmaceutical packaging market size is expected to reach USD 265.70 billion by 2030, registering a CAGR of 9.7% from 2024 to 2030, according to a new report by Grand View Research, Inc., The increasing prevalence of chronic diseases coupled with the growth of the pharmaceutical industry is anticipated to augment the consumption of pharmaceutical packaging products.

Ban on counterfeit products in North America and Europe is expected to be a major driver for the market as major companies are likely to invest heavily in anti-counterfeit packaging products. Blow-Fill-Seal (BFS) technology allows customized design for high-quality containers with tamper-evident closures in multiple shapes and sizes. Therefore, the growing demand for anti-counterfeiting packaging along with the advent of technology is likely to support the growth of tamper-evident pharmaceutical packaging.

Companies are focusing on using sustainable materials for packaging owing to the rising concerns about the generation of packaging waste that is difficult to degrade. Bioplastic is likely to gain traction in the market as it is derived from renewable plant-based sources and is biodegradable unlike plastics and polymers derived from fossil fuels. In May 2022, SGD Pharma has launched the industry’s first Ready-to-Use sterile 100 ml molded glass vials. It is manufactured with SG EZ-fill packaging technology. Such novel sustainable packaging solutions are expected to boost the growth of the market.

Gather more insights about the market drivers, restrains and growth of the Pharmaceutical Packaging Market

Detailed Segmentation:

Market Concentration & Characteristics

The pharmaceutical packaging market is highly fragmented with the presence of large and medium-sized international companies as well as small-sized domestic players. Key players include Amcor plc, Becton, Dickinson and Company, AptarGroup, Inc., Drug Plastics Group, Gerresheimer AG, Schott AG, O-I GLASS, INC.., SGD Pharma, West Pharmaceutical Services, Inc., Berry Global Group, Inc., WestRock Company, International Paper, Comar, LLC, CCL Industries, and Vetter Pharma International.

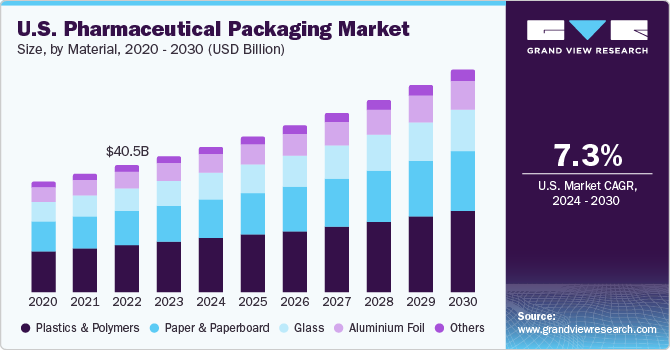

Material Insights

Based on Material, global pharmaceutical packaging material is bifurcated into plastics & polymers, paper & paperboard, glass, aluminum foil, and others.

Plastics & polymers held the highest revenue share of 36.8% in 2023. Various types of plastic resins including PE, PET, PP, PVC, PS, and bioplastic are widely used for manufacturing pharmaceutical vials, bottles, closures, syringes, pouches, sachets, cartridges, tubes, and blister packs. Polypropylene (PP) accounted for the largest revenue share in the plastic & polymers material segment in 2020 as it offers a combination of beneficial properties, such as mechanical, physical, electrical, and thermal characteristics.

Paper & paperboard are majorly used in secondary and tertiary packaging of pharmaceutical products. Excellent printability, low cost, wide availability, and sustainability of paper & paperboard make them lucrative secondary and tertiary packaging options. Paper-based materials are often used as lidding in blister packs on account of their low cost compared to aluminum lidding. International Paper and WestRock Company are some of the leading manufacturers of paper-based packaging.

Product Insights

On the basis of product pharmaceutical packaging market is segment into primary, secondary and tertiary. The primary segment accounted for the major share of the market in 2023. Primary packaging, such as bottles, tubes, or blister packs, directly comes in contact with the drug and thereby envelopes the drug and protects it from contamination. In addition, it is often involved in dispensing and dosing drug contents. Packaging companies are focusing on the easy-to-open closures and incorporation of dispensing systems that deliver the right dose at the right time, which can aid the elderly population in drug dosage.

Drug Delivery Mode Insights

The market is segmented based on drug delivery mode into Oral Drugs, Injectables, Topical, Ocular/ Ophthalmic, Nasal, Pulmonary, Transdermal, IV Drugs, and Others.

The oral drug delivery segment accounted for a significant share of the market in 2023; it plays a crucial role in the pharmaceutical industry by ensuring the safe and effective administration of medications. It protects drugs from environmental factors, maintains stability, and prevents contamination. The packaging also facilitates precise dosing, enhancing patient compliance and overall treatment efficacy. As a critical interface between medication and patients, it contributes to the pharmaceutical industry's goal of delivering reliable and convenient oral drug solutions. Additionally, innovations in this packaging space, such as child-resistant designs and patient-friendly formats, further underscore its importance in promoting safety and patient-centric healthcare experiences.

End-use Insights

Pharma manufacturing is the key end-use segment that accounted for the highest share of 49.9% in 2023 and is expected to witness strong growth from 2024 to 2030. This is owing to the increasing demand for medicines. As per the World Health Organization (WHO), between 2015 and 2050, the proportion of the world’s population of age over 60 years will nearly double from 12% to 22%. The geriatric population requires additional medical assistance, thereby fueling pharmaceutical manufacturing activities. This, in turn, is likely to boost the demand for pharmaceutical packaging.

Regional Insights

North America dominated the market with a revenue share of 35.9% in 2023, wherein pharma manufacturing, which includes in-house production, was the largest end-use segment in the region. The presence of a large number of manufacturers of pharmaceutical plastic bottles in the country, such as AptarGroup Inc., Gerresheimer AG, Amcor Ltd., and Berry Plastics Group, Inc., is likely to have a positive impact on the demand for pharmaceutical plastic bottles over the forecast period.

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

• The global flexible paper packaging market size was estimated at USD 50.35 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030.

• The global seaweed packaging market size was valued at USD 699.23 million in 2023 and is expected to expand at a CAGR of 6.6% from 2024 to 2030.

Key Companies & Market Share Insights

The global market is highly competitive owing to the presence of numerous players across the globe. Moreover, key players are consolidating their market positions mainly by acquisitions, which is further intensifying the competition. Key players directly compete with each other in securing agreements from large-sized pharmaceutical manufacturers. Thus, the competitive rivalry in the global market is observed to be high.

Players are focusing on offering value-added services to attract a greater number of clients. Spray painting, ultraviolet coating, and metallization are the commonly employed processes for coloring packaging containers that are used by packaging manufacturers. In addition, labeling and the incorporation of various anti-counterfeit packaging measures, including overt and covert technologies, such as barcodes, holograms, sealing tapes, and radio frequency identification devices, are often undertaken by the packaging manufacturers.

• In November 2023, Amcor Plc, a renowned global company known for its development and production of environmentally conscious packaging solutions, revealed a Memorandum of Understanding (MOU) with NOVA Chemicals Corporate, a leading producer of sustainable polyethylene. The agreement includes the procurement of mechanically recycled polyethylene resin (rPE) from NOVA Chemicals Corporate, which will be utilized in the production of flexible packaging films. This initiative aligns with Amcor's dedication to promoting packaging circularity by increasing the utilization of rPE in flexible packaging applications.

• In July 2023, Constantia Flexibles introduced a new pharmaceutical packaging solution called REGULA CIRC, which utilizes coldform foil. The packaging replaces conventional PVC with a PE sealing layer, resulting in a reduction in plastic content while increasing the proportion of aluminum. This optimization not only enhances the sustainability of the packaging but also improves material recovery during recycling processes.

• In April 2023, Südpack introduced its PharmaGuard blister, a polypropylene-based blister packaging. This new product offers an outstanding water vapor barrier along with effective barrier resistance against UV and oxygen.

Key Pharmaceutical Packaging Companies:

• Amcor plc

• Becton, Dickinson, and Company

• AptarGroup, Inc.

• Drug Plastics Group

• Gerresheimer AG

• Schott AG

• Owens Illinois, Inc.

• West Pharmaceutical Services, Inc.

• Berry Global, Inc.

• WestRock Company

• SGD Pharma

• International Paper

• Comar, LLC

• CCL Industries, Inc.

• Vetter Pharma International

Pharmaceutical Packaging Market Segmentation

Grand View Research has segmented the pharmaceutical packaging market on the basis of on material, product, drug delivery mode, end-use, and region:

Pharmaceutical Packaging Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Plastics & Polymers

o Polyvinyl Chloride (PVC)

o Polypropylene (PP)

o Homo

o Random

o Polyethylene Terephthalate (PET)

o Polyethylene (PE)

o HDPE

o LDPE

o LLDPE

o Polystyrene (PS)

o Others

• Paper & Paperboard

• Glass

• Aluminium Foil

• Others

Pharmaceutical Packaging Product Outlook (Revenue, USD Million, 2018 - 2030)

• Primary

o Plastic Bottles

o Caps & Closures

o Parenteral Containers

o Syringes

o Vials & Ampoules

o Others

o Blister Packs

o Prefillable Inhalers

o Pouches

o Medication Tubes

o Others

• Secondary

o Prescription Containers

o Pharmaceutical Packaging Accessories

• Tertiary

Pharmaceutical Packaging Drug Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

• Oral Drugs

• Injectables

• Topical

• Ocular/ Ophthalmic

• Nasal

• Pulmonary

• Transdermal

• IV Drugs

• Others

Pharmaceutical Packaging End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Pharma Manufacturing

• Contract Packaging

• Retail Pharmacy

• Institutional Pharmacy

Pharmaceutical Packaging Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Russia

o Turkey

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

o Southeast Asia

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o UAE

o South Africa

o Egypt

Order a free sample PDF of the Pharmaceutical Packaging Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology