Contact Center Analytics Market Trends

The global contact center analytics market size was valued at USD 1.40 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 19.7% from 2023 to 2030. The high demand for analytics among contact centers can be attributed to the benefits it offers, such as improved service quality and the ability to monitor service metrics from employee performance, call times, customer satisfaction, and efficiency. The growing use of social media platforms is also one of the major factors creating the demand for contact center analytics. Customer feedback posted on social media platforms through blogs, posts, and forums is analyzed using contact center analytics solutions, allowing companies to analyze social media content on a real-time basis.

This helps improve business processes and generate a competitive edge. At the same time, it helps companies understand the opinions expressed by the users, including the jargon, abbreviations, slang, and acronyms on social media. These factors are expected to drive the demand for contact center analytics among organizations. The growing demand for Artificial Intelligence (AI)-enabled contact center solutions is expected to create new opportunities for market growth. The ability of these solutions to reduce operational costs, provide actionable analytics, personalize the customer experience, and increase customer agent efficiency is expected to drive their importance and adoption in contact centers.

Gather more insights about the market drivers, restrains and growth of the Global Contact Center Analytics Market

End-use Insights

The IT & telecom segment held the largest revenue share of 24.8% in 2022. Contact center analytics solutions are widely adopted in the IT & telecom industry owing to their extensive business process automation capabilities. In addition, these solutions allow IT & telecom agents to manage all inbound customer interactions and drive end-to-end service request management. Furthermore, these solutions offer a range of benefits, such as better customer satisfaction, operations cost savings, and business intelligence. These solutions are also used by IT & telecom companies to identify factors impacting their customer experience.

Regional Insights

North America dominated the contact center analytics market and accounted for the largest revenue share of 31.6% in 2022. The market growth in North America can be attributed to the presence of prominent players, such as SAP SE, Oracle Corp., and Cisco Systems, Inc. in the region. The presence of a large number of enterprises in North America, which has a larger operation base and several customer contact centers, is expected to drive its growth. Furthermore, the region is witnessing the rising adoption of automated services among businesses, which is driving market growth.

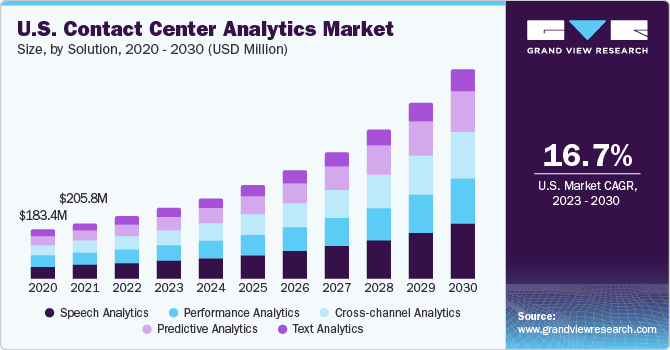

Solution Insights

The speech analytics segment accounted for the largest revenue share of 24.8% in 2022 and is expected to expand at the fastest CAGR of 19.8% over the forecast period. The capability of speech analytics solutions to improve agent performance and goal attainment, and reduce agent churn, among other benefits, is expected to drive the segment growth. These solutions collect insights into the performance of contact centers and other functioning areas within a business. These solutions analyze recorded conversations and help agents identify the solution to resolve customer issues. Moreover, increasing focus on customer satisfaction, coupled with the growing significance of real-time speech analytics solutions is further expected to fuel the segment growth.

Service Insights

The integration & deployment segment accounted for the largest revenue share of around 40.8% in 2022. Integration & deployment services are required to ensure that the new systems are in-line with the existing systems of various departments. The high demand for contact center analytics integration & deployment services can be attributed to the fact that they allow businesses to gain unique access to analytics and customer data by integrating advanced technologies in their operations. Moreover, integration & deployment services focus on regulatory compliance and data privacy needs, thereby generating growth opportunities for the segment.

Deployment Insights

The on-premise segment held the largest revenue share of 56.6% in 2022. Organizations demand on-premises deployment as it offers easy customization of software as per their need. Contact center solutions deployed on-premise are managed and owned by the organization’s telephony group or the internal IT department. On-premise solutions are widely preferred by businesses with specific business continuity requirements and data privacy needs.

Enterprise Size Insights

The large enterprises segment held the largest revenue share of 56.7% in 2022. The high call volume experienced by large enterprises is one of the major factors driving the demand for contact center analytics. In large enterprises, customer data is distributed across all the channels. Analytics solutions allow agents to filter the data as per the customer’s requirement and deliver the required information on time.

Application Insights

The customer experience management segment held the largest revenue share of 18.4% in 2022. The segment growth can be attributed to the benefits offered by the contact center analytics to customer experience management processes, such as reduced customer churn rate, improved crisis management, and lower marketing costs. Customer experience management processes aggregate customer feedback, transactions, interactions, and agent data, which enable businesses to analyze the report for customer experience and agent performance.

Key Companies & Market Share Insights

Market players are regularly focusing on innovations to personalize and differentiate their solution offerings for potential customers. Vendors are also aiming at integrating various technologies, such as Natural Language Processing (NLP), AI, and machine learning, into their solutions to offer effective solutions to their customers. Furthermore, numerous market players are focusing on effectively delivering training & consulting and support & maintenance services to retain their customer base. New product development and partnerships are some of the key strategies adopted by companies to gain a competitive edge in the market.

For instance, in September 2021, Service Management Group, a global patient, customer, and employee experience management company, announced the expansion of its partnership with CallMiner, a conversational analytics provider. Through this collaboration, the former company is delivering new insights to customer experience programs by pairing customer interaction and speech analytics with real-time customer feedback in the smg360 platform.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- Parking Management Market Size, Share & Trends Analysis Report By Solution, By Service, By Deployment, By Parking Site, By Off-Street Parking Site, By Application, By Region, And Segment Forecasts, 2023 - 2030

- 5G Infrastructure Market Size, Share & Trends Analysis Report By Component, By Type, By Spectrum, By Network Architecture, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

Key Contact Center Analytics Companies:

- 8x8, Inc.

- CallMiner

- Cisco Systems, Inc.

- Enghouse Interactive

- Five9, Inc.

- Genesys.

- Genpact Ltd.

- Mitel Networks Corp.

- NICE

- Oracle

- SAP SE

- Verint Systems Inc.

Contact Center Analytics Market Segmentation

Grand View Research has segmented the global contact center analytics market based on solution, service, deployment, enterprise size, application, end-use, and region:

Contact Center Analytics Solution Outlook (Revenue, USD Million, 2017 - 2030)

- Cross-channel Analytics

- Performance Analytics

- Predictive Analytics

- Speech Analytics

- Text Analytics

Contact Center Analytics Service Outlook (Revenue, USD Million, 2017 - 2030)

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

Contact Center Analytics Deployment Outlook (Revenue, USD Million, 2017 - 2030)

- Hosted

- On-premise

Contact Center Analytics Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

- Large

- SME

Contact Center Analytics Application Outlook (Revenue, USD Million, 2017 - 2030)

- Automatic Call Distributor

- Customer Experience Management

- Log Management

- Real-time Monitoring & Reporting

- Risk & Compliance Management

- Workforce Optimization

- Others

Contact Center Analytics End-use Outlook (Revenue, USD Million, 2017 - 2030)

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Travel & Hospitality

- Others

Contact Center Analytics Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Order a free sample PDF of the Contact Center Analytics Market Intelligence Study, published by Grand View Research.

Recent Developments

- In March 2022, Avaya partnered with Alcatel-Lucent Enterprise (ALE), to expand the reach of Avaya's OneCloud CCaas (Contact Center as a Service) composable solutions to ALE's worldwide customer base. Additionally, as part of the collaboration, ALE's digital networking solutions were made accessible to Avaya customers on a global scale.

- In February 2022, NICE partnered with Etisalat Digital to enhance the availability of the CXone platform within the United Arab Emirates (UAE). This collaboration aimed to offer Etisalat customers a smooth transition to the cloud through CXone, enabling effortless digital self-service and agent-assisted customer experiences.

- In February 2022, NICE unveiled the extension of its collaboration with Google, focusing on the enhancement of CXone, the first-ever cloud-native customer experience platform, for Chrome OS. By meeting Google's stringent technical standards, NICE's secure and scalable platform, CXone, is now recognized as an optimized solution for devices within the Chrome OS ecosystem, specifically designed for contact centers. It ensures rapid deployment and provides a seamless experience for customers utilizing Chrome OS devices.

- In May 2021, Mitel Network Corporation partnered with Five, Inc., a leading provider of intelligent cloud contact center solutions. This strategic alliance aimed to offer customers and partners worldwide access to a cutting-edge contact center system that seamlessly integrates with Mitel's unified communications solutions.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database