Defibrillators Market: Key Trends and Growth Drivers

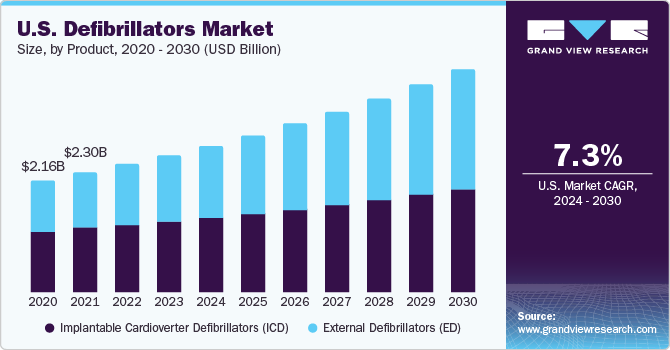

The global defibrillators market was valued at USD 7.32 billion in 2023, with projections for growth at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. Several factors are driving this expansion, including advancements in product development, the rising incidence of sudden cardiac arrest, growing public awareness, and supportive initiatives from both governments and healthcare organizations. A notable example is the May 2021 CE mark awarded to Rapid Response Revival Research Ltd., an Australian company, for its CellAED, the world’s first personal automated external defibrillator (AED) designed for home use. This marked a significant step in the company's growth strategy.

The COVID-19 pandemic had a negative impact on the defibrillator industry, particularly in the International Classification of Diseases (ICDs) market, where demand and sales dropped in 2020. As hospitals resumed elective surgeries, sales started to recover. However, uncertainty persisted throughout the year due to ongoing COVID-19 outbreaks in key markets. For instance, Abbott saw improvements in its hospital-based businesses during the second and third quarters of 2020, but this progress flattened in the fourth quarter due to the resurgence of COVID-19 cases and hospitalizations in many regions. In contrast, Nihon Kohden reported robust sales growth of defibrillators in 2020, despite facing challenges in sales activities caused by the pandemic.

Another significant factor projected to impact the market's growth is the increasing global geriatric population and the ongoing technological advancements in defibrillator devices. Older individuals, particularly those aged 65 and above, are more prone to chronic diseases such as cardiovascular diseases (CVDs), which often necessitate the use of defibrillators to restore normal heart rhythm through electric shocks. For instance, a November 2022 report titled "Senior Population Statistics: A Portrait of Aging Americans" revealed that about 54.1 million people in the U.S. (16.3% of the population) are aged 65 or older. This growing geriatric demographic is expected to drive increased demand for defibrillators as cardiovascular issues become more prevalent within this age group.

Gather more insights about the market drivers, restrains and growth of the Defibrillators Market

Market Dynamics

Rising Prevalence of Cardiovascular Diseases (CVDs):

• CVDs are a major driver of advancements in the defibrillator market, especially due to the significant impact of sudden cardiac arrest on cardiovascular-related deaths.

• As of January 2022, the American Heart Association (AHA) reported that approximately 19 million global deaths were caused by CVDs, as per their "Heart Disease and Stroke Statistics - 2022 Update."

• In July 2022, the Government of Canada stated that 2.6 million Canadian adults aged 20 and older (or about 1 in 12) were diagnosed with heart disease.

Role of Defibrillators in Managing Cardiovascular Conditions:

• Defibrillators are essential for treating and managing heart-related conditions, making them critical to the growth of the defibrillator market.

• As the global burden of CVDs increases, the demand for defibrillators rises, with key industry players introducing innovative solutions to meet this challenge.

Innovative Responses from Key Market Players:

• Companies are focusing on innovation to address the growing market demands.

• For example, Microport, a leader in the Chinese cardiac rhythm management market, achieved an impressive 95% revenue growth in the first half of 2021.

• Microport's success stems from its commitment to innovation, backed by an extensive product portfolio and a robust pipeline, positioning the company as a frontrunner in addressing the evolving needs of the defibrillator industry.

Order a free sample PDF of the Defibrillators Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology