Bancassurance Market Size, Share and Industry Analysis, Report 2024-2032

Bancassurance Industry

Summary:

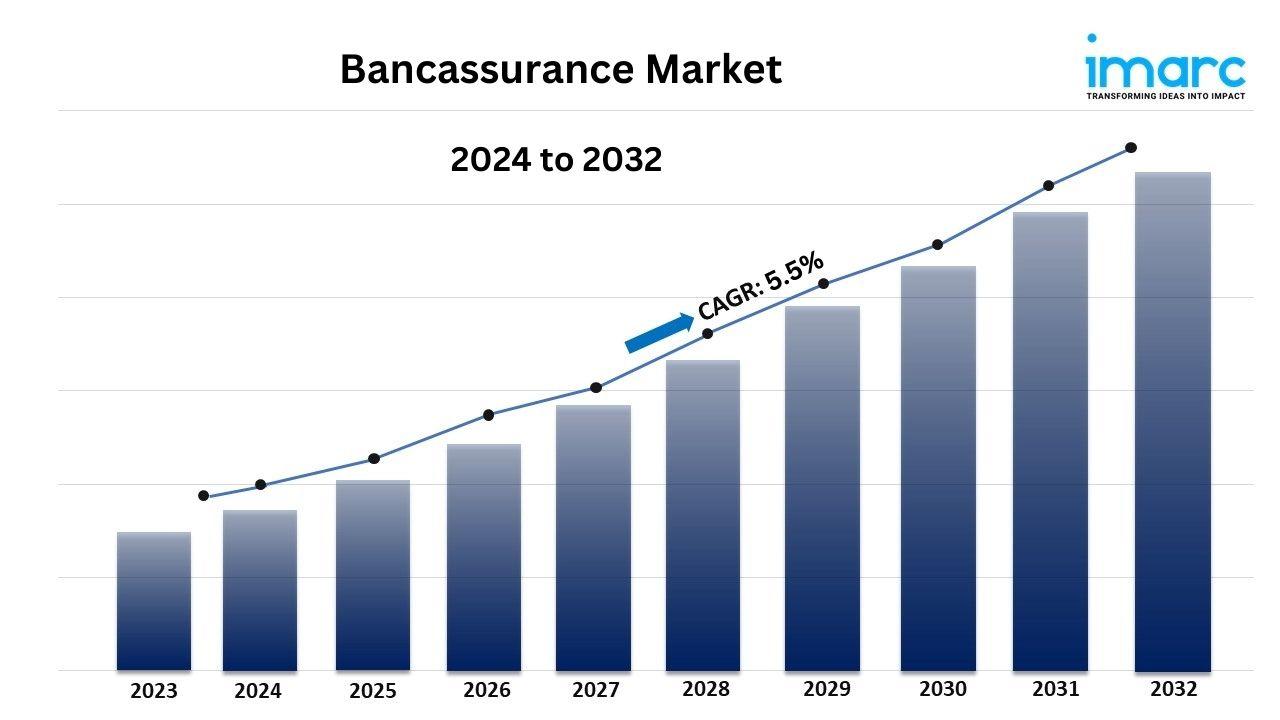

● The global bancassurance market size reached USD 1,428 Billion in 2023.

● The market is expected to reach USD 2,255 Billion by 2032, exhibiting a growth rate (CAGR) of 5.5% during 2024-2032.

● Asia Pacific leads the market, accounting for the largest bancassurance market share.

● Life bancassurance represents the leading product type segment in the market due to the increasing awareness about financial security and life planning.

● Pure distributor holds the largest share in the market.

● The expanding network of banks is a primary driver of the bancassurance market.

● The bancassurance market growth and forecast highlight a significant rise due to governmental policies and regulatory frameworks

Industry Trends and Drivers:

● Expanding banking networks:

With an expanding network of banks globally, the bancassurance market share is gaining significant momentum. Banks are becoming increasingly customer-centric, offering comprehensive services beyond traditional banking to enhance value for their clients. Bancassurance aligns well with this shift, allowing banks to cross-sell insurance products, like life, health, and general insurance, to their existing customers. By leveraging their extensive client databases and long-standing customer relationships, banks can effectively market insurance products, bolstering the overall bancassurance market share. This growth factor is particularly strong in emerging economies where banking penetration is increasing, enabling banks to bring insurance services to underserved or newly banked customers, further driving the market.

● Technological advancements:

Technology-driven improvements are shaping bancassurance market trends, providing more efficient and customer-friendly experiences. Digital tools such as mobile apps, data analytics, and customer relationship management (CRM) platforms are enabling banks to target customers with tailored insurance products based on their financial needs and demographics. This integration supports better client engagement, minimizes operational costs, and enhances regulatory compliance. Furthermore, these technological advances drive bancassurance demand as customers appreciate the convenience of accessing both banking and insurance services through unified digital channels. Financial institutions are thus investing in fintech partnerships and internal IT systems, making digital solutions central to their bancassurance growth strategies.

● Increasing regulatory support:

Government policies and regulatory frameworks supporting partnerships between banks and insurance companies is expanding the bancassurance market size. In many regions, relaxed regulations allow banks to distribute insurance products with fewer limitations, enabling them to reach more customers. For instance, in Europe and parts of Asia, regulatory bodies have introduced reforms to encourage transparent and simplified bancassurance models, enhancing the market’s appeal. As governments and financial regulators promote these collaborations, the overall bancassurance market size expands, benefiting from a more accessible insurance landscape. Consequently, banks and insurers are increasingly seeing the value of cooperation, aligning business models to capture greater market potential.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/bancassurance-market/requestsample

Bancassurance Market Report Segmentation:

Breakup By Product Type:

● Life Bancassurance

● Non-Life Bancassurance

Life bancassurance dominates the market due to the increasing awareness about financial security and life planning.

Breakup By Model Type:

● Pure Distributor

● Exclusive Partnership

● Financial Holding

● Joint Venture

Pure distributor holds the largest share in the market due to low operational cost.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia Pacific holds the leading position owing to a large market for bancassurance driven by the increasing middle-class population with rising disposable income and financial literacy.

Top Bancassurance Market Leaders:

● ABN AMRO Bank N.V.

● The Australia and New Zealand Banking Group Limited

● Banco Bradesco SA

● The American Express Company

● Banco Santander, S.A.

● BNP Paribas S.A.

● The ING Group

● Wells Fargo & Company

● Barclays plc

● Intesa Sanpaolo S.p.A.

● Lloyds Banking Group plc

● Citigroup Inc.

● Crédit Agricole S.A.

● HSBC Holdings plc

● NongHyup Financial Group

● Société Générale

● Nordea Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology