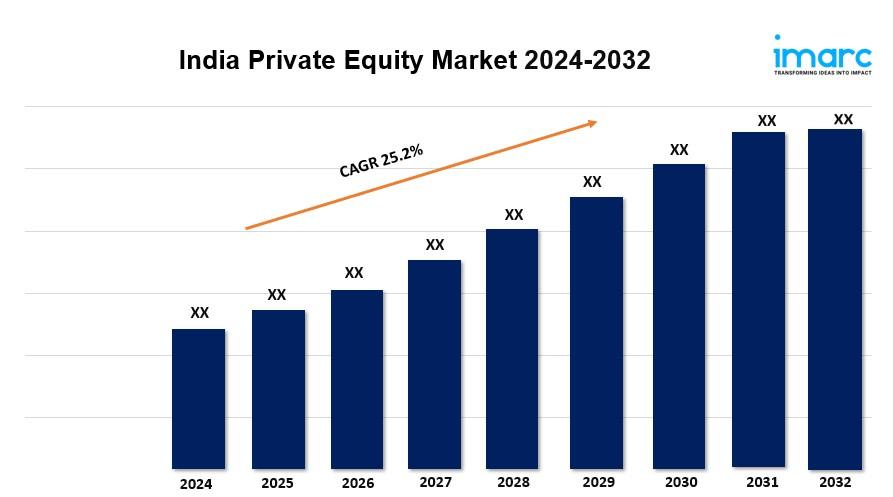

India Private Equity Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 25.2% (2024-2032)

The India private equity market is expanding, driven by technology, consumer sectors, and favorable regulatory reforms, attracting increased foreign investments. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 25.2% from 2024 to 2032.

India Private Equity Market Trends and Drivers:

The fast economic growth, increasing startup environment, and expanding pool of high-net-worth people (HNWIs) are the elements driving the rise of the India private equity market. Furthermore, private equity (PE) businesses are finding plenty of investment possibilities, with industries such as technology, e-commerce, fintech, and healthcare seeing considerable development.

The increased emphasis on digital transformation across industries, combined with government programs such as Digital India and Make in India, has boosted private equity investments. Furthermore, a youthful and dynamic customer base, along with a growing middle class, is driving demand in areas such as consumer goods, retail, and financial services, where private equity companies see significant development opportunities.

Key trends shaping the India private equity market include the increasing interest in venture capital and early-stage investments, particularly in technology-driven startups. PE firms are also focusing on sustainable and impact investing, aligning their strategies with environmental, social, and governance (ESG) principles. This shift is partly driven by global trends as well as domestic regulatory frameworks that promote responsible investing. Another emerging trend is the rise in secondary market transactions, where PE firms buy stakes from other investors, providing liquidity in a maturing market.

Furthermore, the consolidation of fragmented sectors, such as healthcare and logistics, is offering opportunities for private equity firms to create value through mergers and acquisitions. Strong economic fundamentals and evolving investor preferences are expected to sustain the growth of the India private equity market, positioning it as a key destination for global and domestic investment in the coming years.

Request for a sample copy of this report: https://www.imarcgroup.com/india-private-equity-market/requestsample

India Private Equity Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Fund Type:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Breakup by Region:

- South India

- North India

- West and Central India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9949&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145