Urea Price in USA

- United States: 470 USD/MT

In the fourth quarter of 2023, the price of urea in the USA was 470 USD per metric ton.

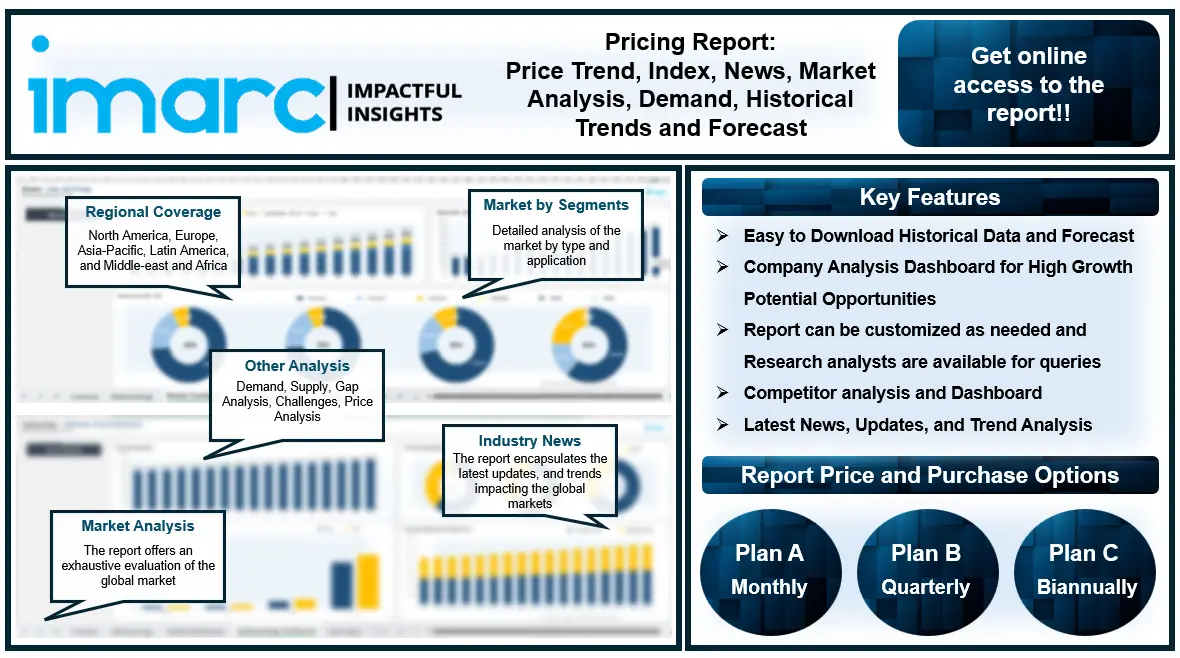

The latest report by IMARC Group, titled "Urea Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data," provides a thorough examination of the Urea Prices. This report delves into the price of Urea globally, presenting a detailed analysis, along with informative Price Chart. Through comprehensive Price analysis, the report sheds light on the key factors influencing these trend. Additionally, it includes historical data to offer context and depth to the current pricing landscape. The report also explores the Demand, analyzing how it impacts Industry dynamics. To aid in strategic planning, the price forecast section provides insights into price forecast, making this report an invaluable resource for industry stakeholders.

Urea Prices Analysis

- China: 350 USD/MT

- Europe: 410 USD/MT

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting urea price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the Industry, equipping stakeholders with the latest information on Industry fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/urea-pricing-report/requestsample

Urea Price Trend- Last Quarter

With the rising global population, the need for enhanced food production is increasing, leading to greater usage of urea in farming practices, which represents one of the key factors positively influencing the market. Besides this, governing agencies of several countries are focusing on food security, enhancing support for fertilizers and crop management practices that enhance yield. Urea is essential in these initiatives, which is propelling the growth of the market. In addition, urea has applications in various industries, including as a feedstock in the production of chemicals like melamine and urea-formaldehyde resins, and in diesel exhaust fluid (DEF) to reduce emissions in vehicles.

In North America, the urea market experienced a decline in the last quarter of 2023 due to subdued demand driven by concerns over potential drought from the El Niño effect. This led consumers to approach bulk purchases cautiously, resulting in lower procurement orders, particularly from significant international markets like India, which shifted focus to the Middle East for their urea needs. Additionally, challenges in the supply chain, exacerbated by insufficient rainfall in South America, impacted market dynamics. The shipment delays lead to inventory accumulation in the US.

Urea Industry Analysis

The Asia-Pacific urea market faced significant challenges in the last quarter of 2023, particularly with notable price declines in China. Factors contributing to this downturn included an oversupply situation due to the cessation of fertilizer exports by China's National Development and Reform Commission, resulting in diminished demand. The conclusion of the autumn season also led to a drop in demand for ammonium nitrate, while a decrease in feedstock prices further pressured urea pricing. Additionally, threats to shipping routes in the Red Sea led to increased freight charges, complicating the import landscape.

In Latin America, particularly Brazil, the urea market observed a downturn in the fourth quarter of 2023, marked by restrained demand amidst adverse weather conditions. While the planting season for key crops like rice, sorghum, and soybeans was ongoing, excessively hot and dry weather in the northern regions, coupled with cooler temperatures in the south, created uncertainty among fertilizer consumers. Despite weather diversities, there was a smooth inflow of urea shipments from the major exporting country, the USA, with no disruptions in the supply chain during this period.

The European urea market exhibited a mixed trend in the fourth quarter of 2023. Initially, prices saw a slight increase driven by supply shortages resulting from production cuts by BASF and the closure of energy-intensive urea plants. However, as the quarter progressed, prices began to decline amid muted demand and uncertainties related to adverse weather conditions and heavy rainfall, which posed threats to crop yields.

In the Middle East and Africa region, the urea market initially displayed bullish trends in the fourth quarter of 2023 but shifted to a downward trajectory by December. Early price increases were fueled by supply shortages due to production cuts by major urea producers and heightened international demand following China's fertilizer export restrictions. As December approached, demand from the Asian market declined post-planting season, and the European market faced limitations due to adverse weather.

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145