Mortgage Calculator vs. Bank Offers: Which Is More Accurate?

A mortgage calculator is an invaluable software that helps potential homeowners establish their monthly mortgage funds based on different factors. By inputting details including the loan volume, interest charge, loan term, and sometimes house fees or insurance premiums, the calculator can rapidly estimate exactly what a borrower can get to pay each month. This software is especially helpful for first-time homebuyers who might not need a definite comprehension of how mortgage payments are organized or what they could afford. Using a mortgage calculator, individuals can gain a better image of the economic obligations and greater program their budget accordingly.

The principal function of a mortgage calculator is to determine the monthly payment. This includes not just the primary and fascination but may also incorporate extra expenses like home fees, homeowners insurance, and even personal mortgage insurance (PMI) if the borrower puts down significantly less than 20% of the home's value. These extra costs can significantly influence the sum total monthly payment, therefore it's very important to component them in when assessing affordability. Some sophisticated mortgage calculators also let people to account fully for homeowners association (HOA) expenses, which could vary with regards to the neighborhood.

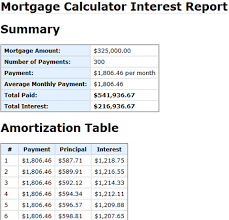

Knowledge how the monthly payment is damaged down is another crucial benefit of utilizing a mortgage calculator. In the early years of a loan, a larger portion of the payment goes toward curiosity as opposed to principal. With time, but, the principal section raises because the loan stability decreases. A mortgage calculator often has an amortization routine, which shows this dysfunction around the life span of the loan. This can help borrowers understand how significantly of these regular payment is going toward reducing the loan stability, and just how much is basically only spending the lender for the use of their money.

Certainly one of the most important factors in determining mortgage obligations may be the fascination rate. The rate at that the loan is financed right impacts just how much a borrower will pay around the life of the loan. Small improvements in interest prices might have a large influence on monthly payments. For example, an increased curiosity rate increases the expense of borrowing, meaning larger regular obligations and more compensated in fascination over time. Alternatively, a diminished rate reduces the regular cost and the entire cost of the mortgage. Mortgage calculators allow customers to test with various fascination charges to observe changes may affect their payments.

Mortgage calculators can also be great for comparing different loan options. For instance, a borrower might want to compare the regular cost on a 15-year loan versus a 30-year loan. The monthly cost for a 15-year mortgage may typically be larger due to the shorter repayment period, but the sum total curiosity paid around the life span of the loan will be lower. By using a mortgage calculator, borrowers can imitate numerous circumstances and decide which loan term most readily useful matches their budget and long-term financial goals.

Along with helping borrowers assess obligations, mortgage calculators also can offer as a tool for qualifying for a loan. Lenders usually use certain requirements, like debt-to-income proportion (DTI), to assess whether a borrower are able a mortgage. A mortgage calculator provides an estimate of the borrower's DTI by Mortgage Calculator in their money and regular debt obligations. By promoting inside their money and different debts, customers can easily see if they match the typical DTI needs for a given loan.

Still another function that numerous mortgage calculators include is the ability to estimate simply how much a borrower are able to afford based on their desired monthly payment. This really is helpful for potential buyers who've a collection budget at heart but aren't positive how much home they could afford. By inputting a goal monthly cost, the calculator can back-calculate the loan total they may qualify for, factoring in the estimated curiosity charge and loan term. This provides consumers a concept of the cost range they should be contemplating when shopping for a home.

Eventually, mortgage calculators are not only for homebuyers—they are also ideal for homeowners who are contemplating refinancing their active mortgage. A refinance mortgage calculator will help establish the influence of refinancing on monthly payments, curiosity prices, and the sum total loan term. It may also show whether refinancing will save profit the long run or whether the expenses of refinancing outnumber the benefits. With the ability to modify loan terms and curiosity charges, homeowners can determine whether refinancing is just a financially sound choice centered on their current

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology