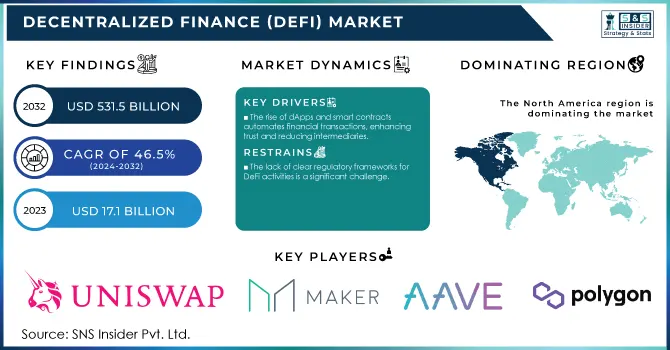

The Decentralized Finance (DeFi) Market Size was valued at USD 17.1 Billion in 2023 and is expected to reach USD 531.5 Billion by 2032, growing at a CAGR of 46.5% over the forecast period 2024-2032.

The Decentralized Finance (DeFi) Market research provides a complete analysis of leading industry competitors, current market developments, and significant trends that influence market growth. The research contains an in-depth analysis of the global market's main determinants, such as drivers, challenges, restraints, and emerging opportunities. The market research includes detailed information on key end-users as well as a yearly projection for the projected period. It also provides revenue forecasts for each year, as well as market sales growth. These forecasts are necessary for acquiring insight into the industry's future prospects.

Download Sample Copy of this Report: https://www.snsinsider.com/request-analyst/4750

Decentralized Finance (DeFi) Market Key Players:

Service Providers / Manufacturers:

l Uniswap Labs (Uniswap v3, Auto Router)

l MakerDAO (Dai, Oasis)

l Aave (Aave Protocol, Aave Arc)

l Compound Labs (Compound Protocol, Compound Treasury)

l Curve Finance (Curve Pool, CurveDAO)

l SushiSwap (SushiSwap Exchange, BentoBox)

l Chainlink Labs (Chainlink Price Feeds, Chainlink VRF)

l Yearn Finance (Yearn Vaults, Yearn Strategies)

l Balancer Labs (Balancer Pool, Balancer Smart Pools)

l Polygon (Polygon zkEVM, Polygon POS)

Key Users of Services and Products:

l Tesla, Inc.

l Microsoft Corporation

l Visa, Inc.

l Goldman Sachs

l PayPal Holdings, Inc.

l Meta Platforms, Inc.

l Shopify

l Amazon Web Services (AWS)

l JPMorgan Chase & Co.

l Apple Inc.

The Decentralized Finance (DeFi) market is rapidly transforming the financial services landscape by leveraging blockchain technology to create an open, permissionless, and transparent alternative to traditional financial systems. DeFi platforms allow users to access a wide range of financial services—such as lending, borrowing, trading, insurance, and yield farming—without the need for intermediaries like banks, brokers, or insurers. Instead, these services are powered by smart contracts, which automate transactions and ensure trustless execution on decentralized networks, primarily based on Ethereum and other blockchain platforms.

The study on the Decentralized Finance (DeFi) Market includes key driving elements as well as major hurdles and restraining factors that stymie market expansion. The study assists established manufacturers and start-ups in developing strategies to overcome obstacles and capitalize on attractive opportunities in the global market. The estimates are based on an in-depth research of the market's geography and are offered by expert analysts in the market.

Market Segmentation

The report is based on a thorough examination of the whole Decentralized Finance (DeFi) Market, as well as all of its sub-segments, using specific classifications. With inputs from industry professionals across the value chain, accurate analysis and assessment are generated from premium primary and secondary information sources. Upstream raw materials, downstream customer surveys, marketing channels, and industry development trends are highlighted in the research, which provides useful information on key manufacturing equipment suppliers, raw materials suppliers, significant distributors, and major consumers.

By Component

l Blockchain Technology

l Decentralized Applications (dApps)

l Smart Contracts

By Application

l Assets Tokenization

l Compliance & Identity

l Marketplaces & Liquidity

l Payments

l Data & Analytics

l Decentralized Exchanges

l Prediction Industry

l Stablecoins

l Others

Browse Complete Report: https://www.snsinsider.com/reports/decentralized-finance-market-4750

Competitive Scenario

The Decentralized Finance (DeFi) Market study provides an in-depth examination of the market's most important competitors. It also includes a detailed financial analysis, business strategy, a SWOT assessment, a business overview, and information on recently announced products and services. The study also includes information on current market trends such as market expansion, mergers and acquisitions, and partnerships and collaborations.

The Decentralized Finance (DeFi) Market research includes a market overview, as well as a SWOT analysis of the top market players, as well as their financial analysis, business overview, and service portfolio analysis. The research covers the most recent changes in the business, such as joint ventures, expansion, and new releases. This research aids players in determining the market's long-term profitability.

Key Highlights of Decentralized Finance (DeFi) Market Report

· A thorough examination of Decentralized Finance (DeFi) Market determinants, upcoming prospects, and obstacles.

· An in-depth market analysis, covering recent market trends and estimates for the next several years that will assist you in making an informed selection.

· An in-depth analysis of the market across many regions that allows market participants to capitalize on market opportunities.

· A complete analysis of each segment, including driving forces and growth rate analysis.

· A comprehensive examination of the top participants in the Decentralized Finance (DeFi) Market industry.