Microgrid Market Research: Exploring User Needs and Market Gaps

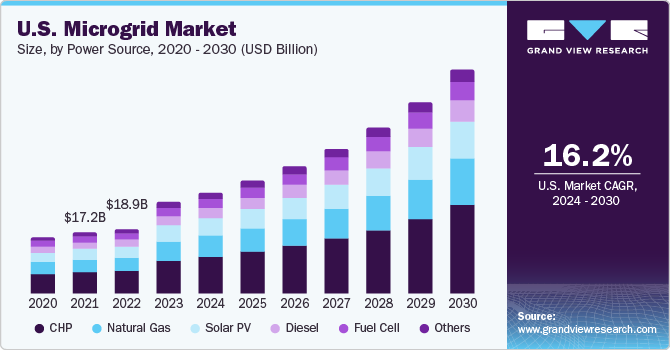

The global microgrid market was valued at USD 76.88 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 17.1% from 2024 to 2030. The increasing power demand in developing countries such as Mexico, China, India, and Russia, driven by growth in the household and industrial sectors, is a key factor behind this expansion. A microgrid, which is a localized electric system capable of operating in parallel with or independent from the main electric grid, is becoming increasingly relevant. The shift from centralized power plants to distributed and localized energy generation systems is enhancing reliability, resiliency, and energy efficiency for cities, communities, and campuses, significantly impacting the market's growth.

Microgrids also contribute to improving local resiliency and stabilizing regional electric grids. The growing reliance on renewable energy sources for power generation is expected to drive future demand for microgrids. Additionally, the manufacturing sector's emphasis on captive power generation systems to reduce dependency on traditional electric grids remains a critical growth driver. Increased awareness of alternative renewable energy sources, such as wind, solar, and hydrogen, is further supporting market expansion.

Gather more insights about the market drivers, restrains and growth of the Global Microgrid Market

Population growth and urbanization in emerging economies have led to increased government investments in infrastructure development. These initiatives are expected to boost power demand, fostering the microgrid industry's growth. Efforts like the Galvin Energy Initiative, which supports the development of smart microgrid prototypes, are creating new opportunities in the market. In addition, the rise of shale gas production in the U.S. and Canada, facilitated by hydraulic fracturing technology, is ensuring greater access to power sources, thereby benefiting the microgrid market.

Regional Insights:

North America Microgrid Market Trends

In 2023, North America dominated the global microgrid market, accounting for over 35% of total revenue. This is largely due to the widespread adoption of captive power generation methods in the industrial and municipal sectors in the U.S., aimed at reducing dependence on government-regulated power supplies. Similarly, the manufacturing and construction sectors in countries like China and India are experiencing growth due to regulatory support encouraging domestic investments, driving the market further. The abundance of mineral reserves in Peru and Chile has bolstered the power distribution market, with strong demand from the mineral processing sectors.

Asia-Pacific Microgrid Market Trends

The Asia-Pacific region is anticipated to grow significantly from 2023 to 2030, fueled by supportive regulatory frameworks in major markets such as China and India. Meanwhile, the Middle East and Africa are also seeing increased adoption of microgrids to enhance energy security and reduce reliance on traditional fuels. Investments by countries like Saudi Arabia and the UAE in microgrid technologies are addressing the energy needs of remote oil and gas facilities and improving rural energy access.

Browse through Grand View Research's Distribution & Utilities Industry Research Reports.

- AI In Energy Market: The global AI in energy market size was valued at USD 8.75 billion in 2023 and is expected to grow at a CAGR of 30.1% from 2024 to 2030.

- Distribution Boards Market: The global distribution boards market size was estimated at USD 4.72 billion in 2023 and is expected to expand at a CAGR of 5.2% from 2024 to 2030.

Key Companies & Market Share Insights

The global microgrid market is highly fragmented, with numerous large and small-scale manufacturers competing intensely. Global players face challenges from regional competitors who possess a better understanding of local regulations and supplier networks. Major companies are focusing on mergers, acquisitions, R&D investments, facility expansions, and value chain integration. For instance, in March 2022, GE Renewable Energy’s Grid Solutions, in collaboration with BOND Civil & Utility Construction, secured an Engineering, Procurement, and Construction (EPC) contract from Empire Wind. This project involves designing and constructing an onshore digital substation for New York’s first offshore wind farm, illustrating the industry’s focus on innovation and expansion.

Key Microgrid Companies:

- ABB

- Siemens AG

- General Electric

- Eaton Corp.

- Exelon

- Honeywell International

- NRG International

- Anarbic

- Pareto

- Spirae

- Northern Power

- Viridity

Order a free sample PDF of the Microgrid Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology