How Big is the Vietnam Fintech Market in 2024-2032

Vietnam Fintech Market Overview

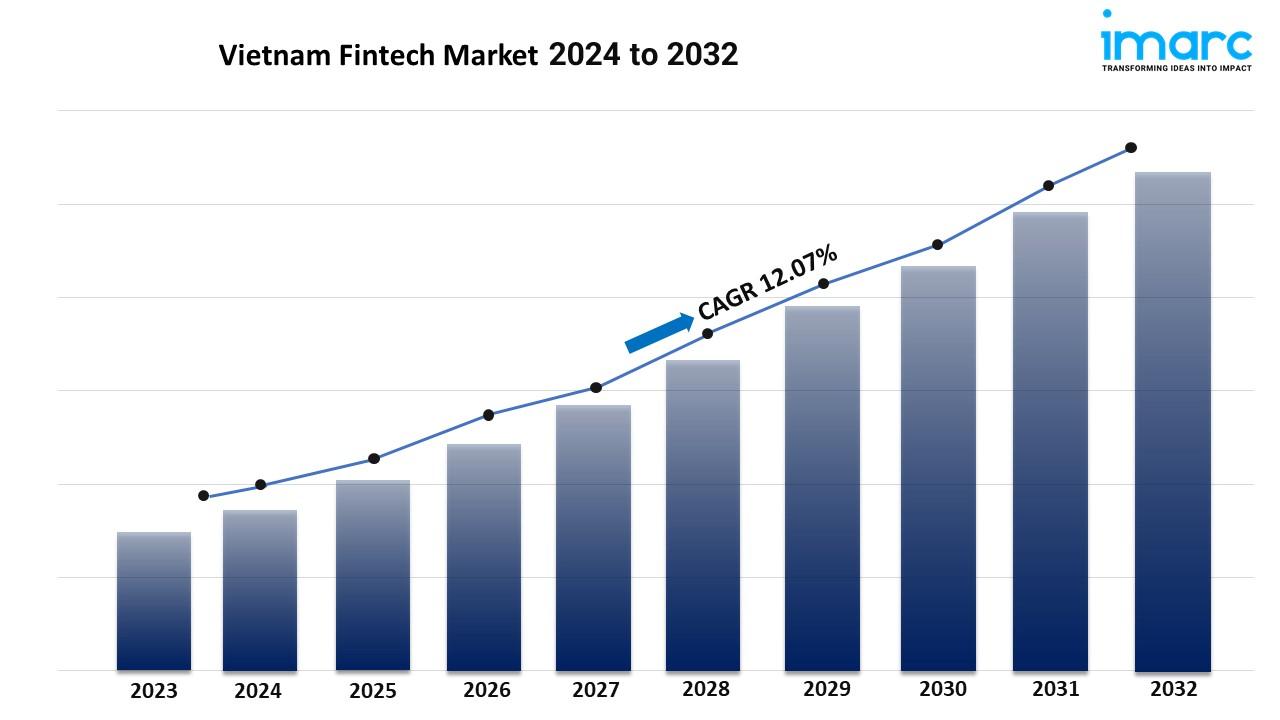

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate:12.07% (2024-2032)

Vietnam's fintech market is booming, driven by the increasing adoption of digital payments and innovative financial services. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 12.07% from 2024 to 2032.

Vietnam Fintech Market Trends and Drivers:

Vietnam's fintech market is growing fast. This is due to several factors. First, more people now have smartphones and internet access. This allows them to use financial services online. Second, the government is supportive.

It has policies, like the National Strategy on Digital Economy Development, that boost fintech. Also, there's a rising demand for affordable financial services. This is especially true for underserved groups. This trend encourages more people to turn to fintech solutions. Finally, increasing trust in digital payments and mobile banking is also driving growth.

Market Trends and Demand in 2024

In 2024, Vietnam's fintech market is set to grow. The rise in mobile payments and digital wallets is boosting cashless transactions. Moreover, AI and machine learning are making fintech services more efficient and secure. The demand for personalized financial advice and wealth management is rising. This boost is spurring the growth of fintech platforms. However, Short-term growth may slow due to challenges. These include cybersecurity threats, regulations, and low financial literacy.

The Vietnam fintech market is undergoing a significant transformation in 2024. Open banking and APIs are boosting collaboration between fintechs and banks. Meanwhile, the demand for embedded finance is pushing financial services into everyday products. Blockchain ensures secure, transparent transactions. However, Data privacy, a lack of skilled workers, and competition from established firms could slow growth.

Vietnam Fintech Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Vietnam fintech market size. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

The report has segmented the market into the following categories:

Type Insights:

- Digital Payments

- Online Purchases

- POS (Point of Sales) Purchases

- Personal Finance

- Digital Asset Management Services

- Remittance/ International Money Transfers

- Alternative Financing

- P2P Lending

- SME Lending

- Crowdfunding

- Insurtech

- Online Life Insurance

- Online Health Insurance

- Online Motor Insurance

- Others

The Vietnam financial technology market is segmented into Digital Payments, enabling cashless transactions; Online Purchases, facilitating e-commerce payments; POS (Point of Sales) Purchases, supporting in-store digital payments; Personal Finance, aiding financial planning and budgeting; Digital Asset Management Services, managing investments digitally; Remittance/International Money Transfers, simplifying cross-border transactions;

Alternative Financing, offering non-traditional lending solutions; P2P Lending, connecting borrowers directly with lenders; SME Lending, providing loans to small and medium enterprises; Crowdfunding, enabling collective funding for projects; Insurtech, digitizing insurance services; Online Life Insurance, offering digital access to life policies; Online Health Insurance, covering healthcare digitally; Online Motor Insurance, addressing vehicle coverage; and Others, including emerging fintech innovations.

B2C Financial Services Marketplaces

- Banking and Credit

- Insurance

- E-Commerce Purchase Financing

- Others

The B2C financial services marketplaces are segmented into Banking and Credit, offering personal loans, credit cards, and banking solutions; Insurance, providing access to various insurance policies; E-Commerce Purchase Financing, enabling installment-based or deferred payment options for online shopping; and Others, covering additional financial services like investment platforms and wealth management.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/vietnam-fintech-market/requestsample

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic, and technological developments for pharmaceutical, industrial, and high-technology business leaders. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology