The global oral solid dosage (OSD) contract manufacturing market was valued at USD 36.50 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.97% from 2024 to 2030. The market's growth is fueled by advancements in drug delivery technologies, including targeted drug delivery and sustained-release dosage forms. Additionally, contract development manufacturing organizations (CDMOs) are heavily investing in expanding capabilities for oral solid dosage development, driven by the rising demand for novel therapies.

The replacement of conventional oral pharmaceutical products with emerging technologies is becoming increasingly likely. For example, the integration of 3D printing in OSD manufacturing offers precise control over drug release and the ability to customize dosage forms tailored to individual patient needs. This technology facilitates the creation of complex shapes and formulations, providing flexibility in drug design and manufacturing. Consequently, these developments are expanding the market for solid-dose pharmaceutical manufacturing, particularly through enhanced efficiency and innovative dose formats.

Gather more insights about the market drivers, restrains and growth of the Global Oral Solid Dosage Contract Manufacturing Market

Advancements in controlled-release technologies are also contributing significantly. These innovations improve drug delivery mechanisms, offering sustained- and extended-release options that enhance therapeutic efficacy and patient compliance. Moreover, adopting digital technologies and data analytics in OSD manufacturing optimizes process monitoring, quality control, and operational efficiency. By utilizing these tools, contract manufacturers provide data-driven and transparent solutions, creating substantial growth opportunities in the market.

Oral Solid Dosage Contract Manufacturing Market Regional Insights:

Asia Pacific Market Trends

In 2023, Asia Pacific dominated the global oral solid dosage contract manufacturing market, accounting for 34.8% of total revenue. The region's growth is driven by improved social insurance schemes and enhanced economic conditions, which increase patients' capacity to cover pharmaceutical expenses. Countries like Singapore, China, and India are key players in the pharmaceutical industry due to their expanding OSD manufacturing capabilities. Over the past decade, pharmaceutical manufacturing has been increasingly outsourced to Asian countries, especially India and China, owing to their cost-effectiveness and robust infrastructure. Additionally, the availability of potential study subjects has attracted pharmaceutical companies such as Eli Lilly and GlaxoSmithKline to conduct clinical trials in countries like India.

North America Market Trends

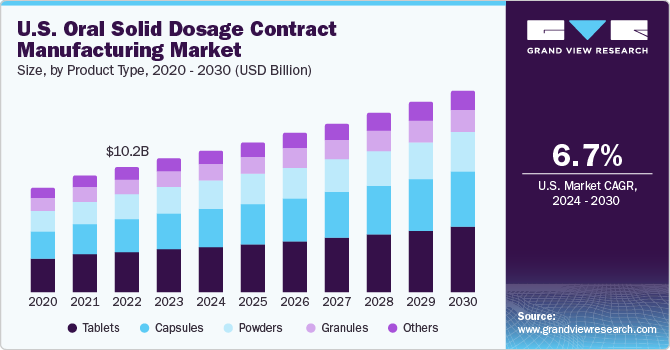

North America is projected to grow at a lucrative rate during the forecast period. This growth is driven by significant investments in R&D for new drug development by pharmaceutical companies, which increases demand for OSD contract manufacturing. The pharmaceutical industry's growth in the U.S. and Canada also contributes to market expansion. Furthermore, the presence of leading market players and numerous ongoing clinical trials in the region are expected to bolster growth.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- Continence Care Market: The global continence care market size was valued at USD 19.68 billion in 2024 and is anticipated to grow at a CAGR of 7.49% from 2025 to 2030.

- Medical Device Validation & Verification Market: The global medical device validation & verification market size was estimated at USD 1.04 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2030.

Key Companies & Market Strategies

Market participants are implementing a variety of strategic initiatives to strengthen their positions and expand their global reach. Common strategies include acquisitions, collaborations, expansions, service launches, and partnerships, which help companies enhance their market presence and revenues. These initiatives often focus on regional expansion or the development of a broader global network to cater to a larger customer base. By adopting these strategies, companies aim to secure a competitive advantage in the rapidly growing market.

Key Oral Solid Dosage Contract Manufacturing Companies:

- Catalent, Inc.

- Lonza

- Aenova Group

- Boehringer Ingelheim International GmbH

- Jubilant Pharmova Limited

- Patheon Pharma Services

- Recipharm AB.

- Corden Pharma International

- Siegfried Holding AG

- Piramal Pharma Solutions

- AbbVie Contract Manufacturing

- Next Pharma AB

Order a free sample PDF of the Oral Solid Dosage Contract Manufacturing Market Intelligence Study, published by Grand View Research.