Dental Practice Management Software Market: Exploring Investment Opportunities for Stakeholders

The global dental practice management (DPM) software market was valued at USD 2.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.17% between 2024 and 2030. This growth is fueled by an increasing number of dental visits, heightened awareness of oral health in regions such as Europe and the U.S., and rapid technological advancements. The Health Information Technology for Economic and Clinical Health (HITEC) Act in the U.S. also promotes the adoption of health information technology, driving the market further. The rising adoption of healthcare IT solutions by specialty clinics, such as dental practices, is expected to increase insurance coverage, consequently boosting the demand for oral health services and the need for DPM software.

Factors Driving Market Growth

Government initiatives supporting oral health have contributed to the growth of independent dental practices, resulting in an increased number of dental visits. For instance, the American Dental Association (ADA) reported that 202,304 dentists were practicing in the U.S. in 2023. Additionally, the workforce is anticipated to grow to 67 dentists per 100,000 people by 2040, driven by rising awareness and demand for dental care. Technological advancements, such as cloud computing and artificial intelligence (AI), are transforming the market. Automated solutions, like Smilefy 4.0 launched in January 2024, allow dental professionals to design 3D smiles and offer patients visual previews of their results, enhancing patient experience and fostering realistic expectations.

Gather more insights about the market drivers, restrains and growth of the Global Dental Practice Management Software Market

Medical Tourism and Cost Considerations

High dental procedure costs in countries like the U.S. and Canada have led many patients to seek affordable dental care in countries such as Mexico and Costa Rica. Costa Rica, for instance, attracts over 42% of its medical tourists for dental care, with 80% of these visitors coming from the U.S. Patients save over 75% on costs while receiving the same quality and standards of service, making medical tourism a key factor influencing the market.

Regional Insights:

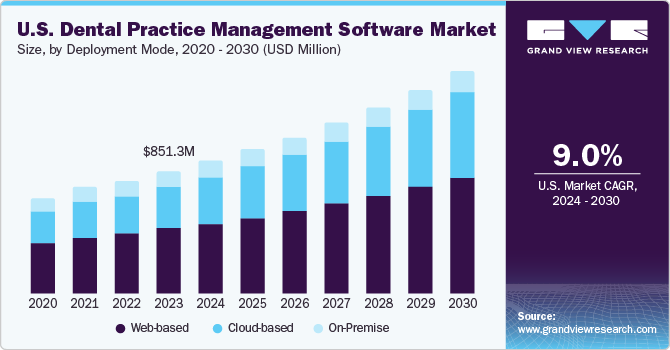

- North America: The region dominated the market with a 40% revenue share in 2023, driven by supportive healthcare IT regulations, a high-income population, and the presence of major players like Curve Dental and Henry Schein One. The growing adoption of oral care services among baby boomers also contributes to this growth.

- United States: The U.S. held the largest market share in 2023, with approximately 201,117 practicing dentists, a 2.7% increase from 2015.

- Canada: Canada is projected to witness the fastest CAGR due to growing oral health awareness and rising demand for dental health services

Europe Market Trends

Europe is expected to experience significant growth due to advancements in technology and increasing disposable income. The UK is focusing on raising oral health awareness among children, while Germany led the region in market share in 2023 due to rising oral health awareness. Denmark is set to witness the fastest growth due to the adoption of advanced IT frameworks in dental practices.

Asia Pacific Market Trends

The Asia Pacific region is forecasted to grow at the fastest CAGR during the projected period. Japan held the largest market share in 2023, owing to the prevalence of dental disorders and robust healthcare infrastructure. In India, a high prevalence of oral health issues, including oral cancer due to poor hygiene, tobacco use, and sugary diets, is anticipated to drive demand for DPM software, leading to significant market growth.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- Teledentistry Market: The global teledentistry market size was estimated at USD 2.02 billion in 2024 and is projected to grow at a CAGR of 15.3% from 2025 to 2030.

- Cloud-based Dental Practice Management Software Market: The global cloud-based dental practice management software market size was valued at USD 721.0 million in 2023 and is projected to grow at a CAGR of 11.4% from 2024 to 2030.

Competitive Landscape:

The market is fragmented, with several regional and emerging players entering the space to meet the growing demand for mobile health solutions and cater to an aging population. Notable companies include Dental Intelligence, Inc., Jarvis Analytics, Practice Analytics, ABELMed Inc., and Practice-Web, Inc. These companies are leveraging innovative technologies to gain a competitive edge in the growing market.

Key Dental Practice Management Software Companies:

- Henry Schein, Inc.

- Carestream Dental, LLC

- DentiMax

- Practice-Web, Inc.

- Nextgen Healthcare, Inc.

- ACE Dental Software

- Datacon Dental Systems, Inc.

- CareStack (Good Methods Global Inc.)

- CD Nevco, LLC (Curve Dental)

- Dentiflow

Order a free sample PDF of the Dental Practice Management Software Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology