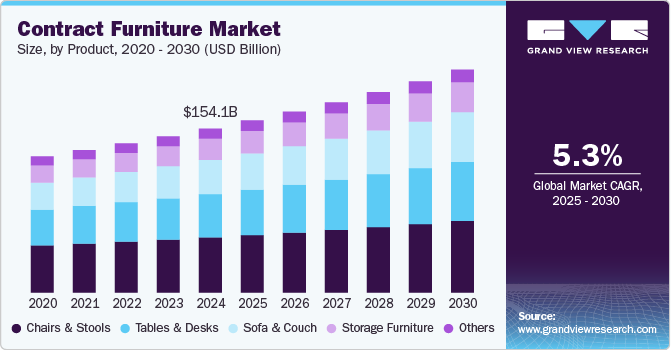

The global contract furniture market was valued at an estimated USD 154.10 billion in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2030. This growth is fueled by increasing demand for ergonomic, sustainable, and flexible furniture solutions in commercial spaces. Additionally, the rise of remote and hybrid work models and significant investments in hospitality and office infrastructure are further contributing factors. The adoption of digital marketing strategies and the shift to online distribution channels are also enhancing market expansion.

Countries like China, India, the U.S., the UAE, and the UK are witnessing a surge in commercial developments, including corporate office buildings, retail spaces, luxury hotels, and industrial complexes, leading to increased demand for contract furniture. For instance, Growth Natives, a U.S.-based marketing and customer engagement agency, expanded its corporate offices in November 2022, reflecting the growing need for adaptable workspaces. The company, which reached a milestone of 300 employees within three years, now operates offices spanning India, the U.S., and Canada, covering over 30,000 square feet. Such corporate expansions underscore the growing demand for contract furniture solutions to furnish dynamic and functional work environments.

Gather more insights about the market drivers, restrains and growth of the Global Contract Furniture Market

Moreover, the commercial realty sector is thriving, as highlighted by a December 2023 report on the financialexpress.com, which noted a 33% increase in gross office space leasing across nine Indian metro cities during Q3 2023. This trend indicates sustained investments in office spaces and commercial buildings, further driving contract furniture demand.

Contract Furniture Market Regional Market Insights:

- North America: Accounting for 27.62% of the global market revenue in 2024, North America leads in integrating advanced technologies like cloud-based ERP systems into the contract furniture industry. Companies such as Meadows Office Interiors streamline operations and improve efficiency using these tools, offering services like order tracking, inventory management, and post-sales support.

- United States: The U.S. contract furniture market is projected to grow at a CAGR of 4.2% from 2025 to 2030, driven by increasing demand for ergonomic and flexible furniture and sustainability-focused innovations. The rise of hybrid work environments and investments in hospitality and healthcare sectors further bolster growth.

- Europe: With over 25% of the global market revenue share in 2024, Europe shows a rising inclination toward flexible classrooms and ergonomic furniture in educational institutions. This trend, particularly in the UK, is supported by increased leasing activity in schools and colleges, as highlighted by a Savills blog post in May 2023.

- Asia Pacific: Expected to grow at a CAGR of 6.3% from 2025 to 2030, the Asia Pacific market benefits from rapid urbanization, rising commercial construction activities, and growing demand for premium furnishings. Companies like Indonesia's Warisan are capitalizing on opportunities by supplying high-end furniture for global boutique hotels and resorts.

Browse through Grand View Research's Homecare & Decor Industry Research Reports.

- Artificial Flowers Market: The global artificial flowers market size was estimated at USD 3.09 billion in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030.

- Outdoor Kitchen Market: The global outdoor kitchen market size was estimated at USD 24.45 billion in 2024 and is expected to grow at a CAGR of 8.9% from 2025 to 2030.

Key Players and Strategic Insights

The contract furniture market is fragmented, with major players including Steelcase, Herman Miller, Haworth, HNI Corporation, and KI. These companies emphasize strategies such as expansions, partnerships, product launches, and sustainability initiatives. For example, in July 2023, Haworth Inc. announced a new manufacturing facility in Chennai, India, with an investment of USD 8-10 million. Set to begin production by 2025, this plant aims to serve both domestic and international markets, including West Asia and Southeast Asia, to meet growing demand.

This combination of market drivers, regional trends, and strategic expansions highlights the robust growth trajectory of the global contract furniture industry.

Key Contract Furniture Companies:

- Haworth Inc.

- Herman Miller Inc.

- Kinnarps Group

- Steelcase Inc.

- HNI Corporation

- Sedus Stoll AG

- KI

- Global Furniture Group

- Martela

- Teknion

- Knoll Inc.

- Kimball International Inc.

Order a free sample PDF of the Contract Furniture Market Intelligence Study, published by Grand View Research.