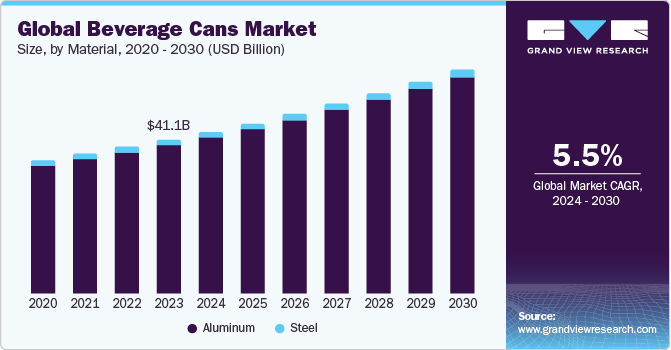

The global beverage cans market size was estimated at USD 59.61 billion in 2030 and is expected to expand at a CAGR of 5.5% from 2024 to 2030. The demand for highly portable and superior beverage packaging for protection from the external environment is primarily contributing to market growth. The rising demand for aluminum cans on account of superior properties such as lightweight and growing aluminum recycling is further driving the market.

The continuous technological advancements in the market which include machinery automation, printing technology, and raw material advancements are further contributing to the market growth. For instance, Ball Corporation introduced the Dynamark variable printing technology that allows for customized printing of beverage cans with a single pallet. The technology offers numerous options for high-quality printing, keeping the time required to change the designs to a minimum.

The aluminum can segment is leading the global market with major revenue and volume share. Manufacturers are continuously focusing on research and development activities associated with aluminum cans to cater to the increasing demand for sustainability in the global market. For instance, The Coors Brewing Company uses ultraviolet (UV) light curing technology for its aluminum beverage cans. The company uses coating materials that cure when exposed to UV light and offers a low-cost alternative to the expensive heat treatments used in conventional convective heat ovens for curing the inks. In addition, the UV cured method creates lower emissions and a smaller waste stream owing to the lesser solvent usage compared to its alternatives.

Gather more insights about the market drivers, restrains and growth of the Global Beverage Cans Market

The increasing demand for various fruit juices and sports drinks in can packaging is expected to benefit the market growth. Additionally, the growing consumption of ready-to-drink beverages that primarily uses cans as packaging is further boosting the market growth. Manufacturers operating in the fruit and vegetable juices market such as Nestle, Welch Foods Inc, and De Monte are increasingly focusing on offering attractive packaged juices to customers in order to attract them and are also moving toward sustainability.

Companies operating in the beverage industry establish direct contracts with beverage cans manufacturers to cater to their specific demands while mitigating the risk of price fluctuations. Direct supply agreements are observed between large-sized beverage companies and beverage cans manufacturers, wherein a high level of product customization is undertaken. These supply agreements guarantee uniform packaging demand, which eases the production and distribution planning for beverage companies.

Beverage Cans Market Report Highlights

- In terms of revenue, the steel segment is projected to ascend at a CAGR of 2.3% over the forecast period. As steel has ambient nature, cans made from it need not be cooled during the packaging and shipping process, thereby simplifying logistics and enabling cost-saving storage. Steel cans are easily separated in recycling facilities from other waste using magnetic equipment, also can be recycled repeatedly without losing the quality of steel. Thus the material is experiencing growth in the global market

- The aluminum segment accounted for the maximum volume share of 95.2% in 2022. The increasing focus on the recycling of discarded metal products is projected to support the growth of the aluminum can market over the forecast timeframe is projected to support the market growth. According to National Packaging Waste Database, the recycling rate of aluminum rose to 56% in 2019, increasing year on year by 4% from 52% in 2018 and 41% from 2010

- Companies in the industry for beverage cans have been continuously improving the aesthetics, product strength, and shelf life of the packaged beverage. In July 2021, BALL CORPORATION announced its plans to build new aluminum beverage packaging plants in the U.K. With significant growth of sustainable cans in categories, including wines, waters, hard seltzers, and ready-to-drink cocktails, the company also plans to open new cutting-edge facilities for facilitating increased revenue and increase its market share in the country

Browse through Grand View Research's Food Safety & Processing Industry Research Reports.

- Beverage Packaging Market: The global beverage packaging market size was estimated at USD 157.73 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030.

- Beverage Flavoring System Market: The global beverage flavoring system market size was estimated at USD 4.7 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2020 to 2028.

Beverage Cans Market Segmentation

Grand View Research has segmented the global beverage cans market report on the basis of material, application, and region:

Beverage Cans Material Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

- Aluminum

- Steel

Beverage Cans Application Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

- Carbonated Soft Drinks

- Alcoholic Beverages

- Fruits & Vegetable Juices

- Other Applications

Beverage Cans Regional Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Belarus

- Bulgaria

- Czech Republic

- Poland

- Hungary

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Kazakhstan

- Uzbekistan

- Tajikistan

- Central & South America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Middle East & Africa

- South Africa

- Ghana

- Nigeria

- Kenya

- Mauritius

- Egypt

- Iran

- Kuwait

- Israel

- Saudi Arabia

- UAE

Order a free sample PDF of the Beverage Cans Market Intelligence Study, published by Grand View Research.