The global clinical laboratory service market size is expected to reach USD 286.77 billion by 2030, registering a CAGR of 3.5% from 2024 to 2030, according to a new report by Grand View Research, Inc. The growth of the industry can be attributed to the increasing prevalence of the geriatric population, which, in turn, is propelling the demand for early disease diagnosis. The growing prevalence of target diseases, such as diabetes and Cardiovascular Diseases (CVDs), is a high impact-rendering driver for industry growth over the forecast period. Cardiovascular disease is the leading cause of death globally. The presence of unmet medical needs pertaining to disease management and the subsequent increase in patient awareness in more regions are expected to boost the demand for clinical laboratory testing.

Improvements in laboratory testing technology throughbreakthrough and incremental advances are high-impact-rendering drivers for industry growth. Market firms are engaged in introducing new services to serve the unmet demand of patients. For instance, in May 2022, Hamilton County entered into a partnership with Ethos Laboratories for the launch of no-cost COVID-19 testing sites. In July 2022, Mayo Clinic laboratories launched monkeypox tests to increase availability and accessibility to a wider target population. Moreover, in January 2022, Quest Diagnostics launched COVID-19 rapid antigen tests available through QuestDirect in collaboration with eMed to provide access to testing for COVID-19 at home. The pandemic affected millions of people globally. According to the CDC and WHO, the standard for diagnosis of COVID-19 is RT-PCR for samples from the respiratory tract.

Gather more insights about the market drivers, restrains and growth of the Global Clinical Laboratory Service Market

The adoption of PCR technology for the diagnosis of COVID-19 and the genetic sequencing of the virus for the development of a cure is driving the industry. Due to this pandemic, there is an increase in the approval of tests for the diagnosis of the novel coronavirus, with most of these tests approved under Emergency Use Authorization (EUA) by federal agencies. Furthermore, the industry operates through different sales channels—laboratories and hospitals. The presence of prominent players in various regions is expected to drive the industry. For instance, in February 2022, Labcorp entered into a comprehensive partnership with Ascension. Through this collaboration, Labcorp will handle Ascension’s hospital-based labs situated in ten states for buying assets for its outreach laboratory business.

Clinical Laboratory Service Market Report Highlights

- In 2021, the clinical chemistry segment held a dominant share owing to the increasing need for pathology analysis

- The hospital-based laboratories segment is projected to grow at the fastest CAGR over the forecast period owing to increasing hospital-integrated laboratories

- The bioanalytical & lab chemistry services segment was the highest revenue-generating segment in 2023 due to the increasing drug discovery and developmen

- The industry has seen unprecedented growth due to the introduction of innovative services to address the rising demands

- Asia Pacific is expected to witness the fastest CAGR during the forecast period due to improved manufacturing facilities and an increasing prevalence of chronic disease

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

- Blood Testing Market: The global blood testing market size was estimated at USD 96.62 billion in 2024 and is projected to grow at a CAGR of 8.83% from 2025 to 2030.

- Self-testing Market: The global self-testing market size was valued at 11.39 billion in 2024 and is projected to grow at a CAGR of 8.40% from 2025 to 2030.

Clinical Laboratory Service Market Segmentation

Grand View Research has segmented the global clinical laboratory services market based on test type, service provider, application, and region:

Clinical Laboratory Service Test Type Outlook (Revenue, USD Million, 2018 - 2030)

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

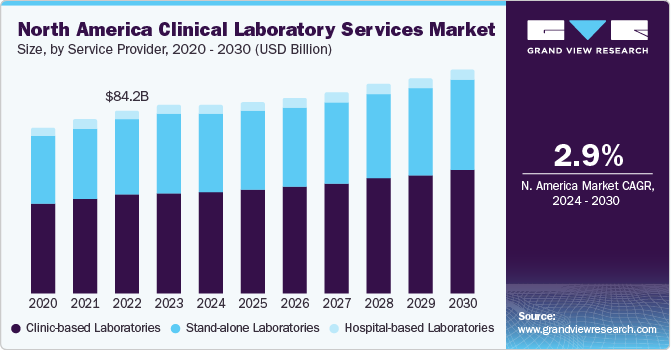

Clinical Laboratory Service Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital-based Laboratories

- Stand-alone Laboratories

- Clinic-based Laboratories

Clinical Laboratory Service Application Outlook (Revenue, USD Million, 2018 - 2030)

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

Clinical Laboratory Service Regional Outlook (Revenue, USD Million, 2018- 2030)

- North America

- S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Colombia

- Peru

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Clinical Laboratory Service Market Intelligence Study, published by Grand View Research.