The global ethylene propylene diene monomer market size is expected to reach USD 6.89 billion by 2030, registering a CAGR of 5.7% from 2023 to 2030, according to a new study by Grand View Research, Inc. Ethylene Propylene Diene Monomer (EPDM) is a type of high-density rubber, which is mainly used for outdoor applications. It offers excellent resistance to ozone, aging, and heat. In addition, it exhibits high electrical insulation, excellent low-temperature properties, and moderate physical strength. Elastomer blends have a high demand in various end-use industries due to the limitations posed by elastomers, such as silicone, EPDM, nitrile rubber, natural rubber, butadiene rubber, and neoprene.

Often, the cost of superior-grade elastomers is high, which limits their use in various applications, such as automotive, construction, medical, industrial, consumer goods, and wires & cables. Elastomer blending is used for enhancing the performance characteristics of rubber products. Asia Pacific has established itself as a substantial contributor to global EPDM demand. End-use sectors including automotive, construction, and manufacturing are driving the product demand in the region, notably in India, China, and other Southeast Asian nations. Growing population and rapid urbanization & industrialization in developing economies have spurred federal governments to expand construction spending to meet the region's increasing infrastructure development.

Gather more insights about the market drivers, restrains and growth of the Global Ethylene Propylene Diene Monomer Market

As a result, rising government construction investments, notably in China and India, are likely to stimulate product demand in infrastructure and construction applications. The automotive application segment dominated the global industry in 2021 and is likely to expand further at a steady CAGR from 2022 to 2030. Led by abundant demand in manufacturing radiators, heater hoses, door seals, and others globally, EPDM is witnessing augmented demand. Increasing utilization of EPDM in blends along with other polymers for car bumpers, rub strips, and fender extensions are also driving the industry growth. In addition, the growing automotive manufacturing sector in emerging economies is also influencing the demand for EPDM.

Major ethylene producers in the industry include SIBUR, Formosa Plastics Group, China Petrochemical Corp., SABIC, Dow, Reliance Industries Ltd., Kuwait Petrochemical Corp., Royal Dutch Shell PLC, ExxonMobil Corp., and Zhejiang Petrochemical Group. Companies, such as China Petrochemical Corp. and Total S.A., are expected to lead the global industry, in terms of annual ethylene capacity additions. The global capacity is anticipated to rise from 184.5 million tons per annum to 261.7 million tons per annum by 2026. Nearly 116 new production plants are expected to be established in Asia and the Middle East regions over the coming years.

Ethylene Propylene Diene Monomer Market Report Highlights

- Asia Pacific dominated the global market in 2022 with a revenue share of more than 41.10%. This trend is projected to continue over the forecast period.

- The automotive and construction industries in the Asia Pacific are growing considerably due to rapid urbanization, government expenditure, foreign investments, and consumer spending. Moreover, a surge in the demand for green buildings, particularly in China, is expected to drive the construction industry, thereby, driving the product demand

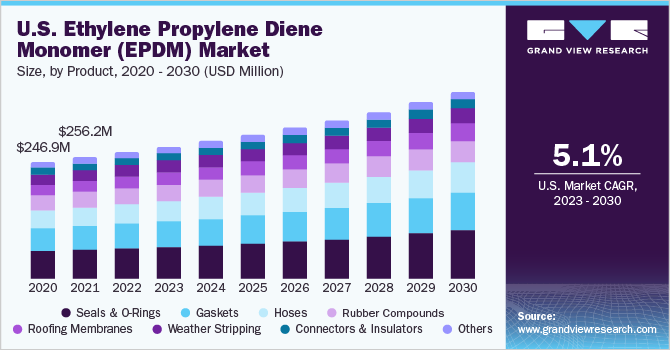

- Seals and O-rings was the largest product segment in 2022 and are also anticipated to dominate the industry over the forecast period

- EPDM rubber is widely used in the manufacturing of ‘O’ rings for aerospace, marine, and automotive applications due to its excellent resistance to non-polar solvents, acids, motor oils, diesel fuel, and gasoline. However, it performs poorly when exposed to the weather, ozone, UV light, and steam

- In March 2022, ARLANXEO’s EPDM plant in Changzhou announced to increase in its annual production capacity by 15%. This production expansion initiative is aimed to support the production of various Keltan grades for use in components for 5G construction, ultra-high voltage, charging piles, and big data centers in new infrastructure areas

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

- Thermoplastic Elastomers Market: The global thermoplastic elastomers market size was estimated at USD 25.15 billion in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030.

- Corrosion Resistant Resin Market: The global corrosion resistant resin market size was valued at USD 8.38 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030.

Ethylene Propylene Diene Monomer Market Segmentation

Grand View Research has segmented the global ethylene propylene diene monomer market based on product, application, and region:

Ethylene Propylene Diene Monomer Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

- Hoses

- Seals & O-Rings

- Gaskets

- Rubber Compounds

- Roofing Membranes

- Connectors and insulators

- Weather Stripping

- Others

Ethylene Propylene Diene Monomer Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

- Building & Construction

- Wires & Cables

- Electrical & Electronics

- Lubricant Additive

- Plastic Modifications

- Automotive

- Tires & Tubes

- Others

Ethylene Propylene Diene Monomer Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- K.

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

Order a free sample PDF of the Ethylene Propylene Diene Monomer Market Intelligence Study, published by Grand View Research.