Rodenticides Market Growth & Trends

The global rodenticides market size is anticipated to reach USD 8.13 billion by 2030, according to a new report by Grand View Research, Inc., registering a CAGR of 5.6% during the forecast period. Increased prevalence of rodent-related diseases and rising demand for rodent control are likely to be major factors driving market growth.

Increasing urbanization, coupled with demand to maintain high hygiene standards in the business, public, and residential sectors, is expected to augment demand. Over 54.0% of the world’s total population resides in urban areas, which is likely to register an increase of 66.0% by 2025, according to the United Nations (UN). Increasing population and rising consciousness regarding healthy environment are likely to augment demand for rodenticides over the coming years.

Gather more insights about the market drivers, restrains and growth of the Rodenticides Market

Stringent government policies regarding active ingredients used in production of rodenticides is predicted to be a major limiting factor over the forecast period. For instance, in Canada, only zinc phosphide and strychnine are registered for use as rodenticides. Natural rodenticides use non-toxic and food grade ingredients approved by the EPA.

Rodenticide manufacturers are continuously engaged in research and development of active ingredients for production of superior quality products that provide higher efficiency. Companies lay high emphasis on increasing their regional presence in order to tap unexplored markets.

Rodenticides Market Report Highlights

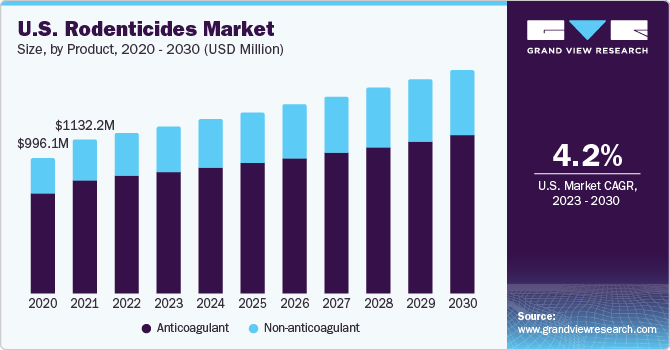

- By product, the non-anticoagulant segment is expected to expand at the fastest CAGR of 6.4% during the forecast period due to higher efficiency in destroying rodents in comparison to anticoagulants

- The powder segment accounted for a notable revenue share in 2022. Use of such modes spreads particles into the air when used in ventilation, which, in turn, could harm pets and humans

- The Central & South America region is expected to advance at a significant CAGR during the forecast period. Rising rodent population in the region is a limiting factor for development or introduction of some crops, which is likely to propel demand for rodent control products in the coming years

- Manufacturers are engaged in various acquisitions and new product developments to gain prominence in the market. For instance, Rentokil Initial plc acquired Vector Disease Acquisition, LLC in November 2017 to expand its presence in North America.

Browse more reports published by Grand View Research.

- Neem Extracts Market Size, Share & Trends Analysis Report By Application (Personal Care, Pharmaceutical, Fertilizers, Animal Feed), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2024 - 2030

- Agrochemicals Market Size, Share & Trends Analysis Report By Product (Fertilizers, Crop Protection Chemicals), By Application (Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables), By Region, And Segment Forecasts, 2024 - 2030

Rodenticides Market Segmentation

Grand View Research has segmented the global rodenticides market on the basis of product, form, application, and region:

Rodenticides Product Outlook (Revenue, USD Million, 2018 - 2030)

- Anticoagulant

- Non-anticoagulant

Rodenticides Form Outlook (Revenue, USD Million, 2018 - 2030)

- Pellets

- Blocks

- Powder

Rodenticides Application Outlook (Revenue, USD Million, 2018 - 2030)

- Agriculture

- Pest Control Companies

- Warehouses

- Urban Centers

- Household

Rodenticides Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

Order a free sample PDF of the Rodenticides Market Intelligence Study, published by Grand View Research.