Cargo Inspection Market Growth & Trends

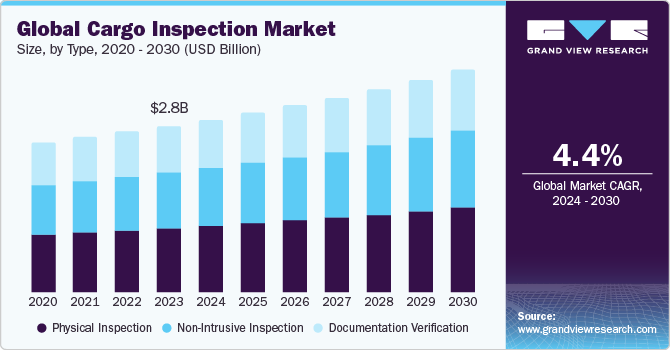

The global cargo inspection market size is anticipated to reach USD 3,790.4 million by 2030, registering a CAGR of 4.4% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market safeguards international trade by verifying the quality, safety, and regulatory compliance of goods crossing borders. This comprehensive process involves physical cargo examinations, meticulous document verification to ensure adherence to standards, and laboratory testing when necessary, minimizing risk throughout the supply chain. Key stakeholders in this market include governments, importers, exporters, manufacturers, and insurance companies. The diverse range of cargo inspected encompasses everything from bulk commodities to complex manufactured goods and perishable items. Increasing globalization and international trade fuel the demand for cargo inspection services.

This surge stems from the need to mitigate risks like fraud, safety breaches, and counterfeit goods. Stringent regulations necessitate robust inspections to ensure compliance and safety standards. In addition, increasing concerns about product quality and security drive the demand for specialized inspections. Fortunately, advancements in technology, such as digital documentation and non-intrusive inspection tools, are enhancing both efficiency and accuracy in cargo inspections. Despite benefiting from globalization and trade expansion, the market faces persistent challenges. These include considerable expenses associated with implementing advanced technologies & retaining qualified personnel, complexities inherent in global supply chains, and regulatory frameworks that impede seamless inspection procedures.

Gather more insights about the market drivers, restrains and growth of the Cargo Inspection Market

Moreover, geopolitical tensions and trade conflicts introduce additional uncertainties, potentially disrupting trade patterns and reducing the demand for inspection services. Digitalization and automation are revolutionizing the market. AI-powered systems and blockchain documentation streamline processes, leading to faster and more accurate inspections. Collaboration between inspection companies and industry stakeholders is flourishing, enabling them to address evolving market needs and stay ahead of regulatory changes. Furthermore, the growing focus on sustainability and the rise of e-commerce drive the demand for specialized inspections that ensure eco-compliance and product authenticity. Adopting AI and machine learning (ML) further unlocks opportunities for innovation and enhanced efficiency in this dynamic market.

The competitive landscape of the industry is characterized by the presence of established players and new entrants, such as SGS Group, Bureau Veritas, Intertek Group, TÜV SÜD, DEKRA SE, DNV GL, and AmSpec Group. Established inspection companies leverage their experience and expertise to offer comprehensive inspection services across various sectors and industries. Meanwhile, emerging players focus on niche markets and innovative solutions to achieve a competitive edge. Overall, competition in the market is intense, with companies striving to differentiate themselves through technological advancements, service quality, and customer satisfaction.

Cargo Inspection Market Report Highlights

- The global market growth is driven by factors like increased international trade volumes, growing concerns about product safety & quality and the rising prevalence of counterfeit goods & intellectual property theft

- Market growth faces potential hurdles, including the inflated cost of advanced inspection technologies and skilled labor, the complexities inherent in global supply chains, and ongoing geopolitical tensions

- Digitalization, automation with AI, and blockchain technology are creating significant opportunities for faster, more precise inspections. This focus on technological advancements aligns with the growing demand for specialized inspection services driven by the rise of sustainability and e-commerce

- Physical inspections currently dominate the market, playing a critical role in safeguarding the integrity and compliance of goods during transport. These inspections are essential for guaranteeing consumer safety and fostering trust within the international trade landscape

- The agricultural industry is expected to witness the highest growth rate of 5.2% from 2024 to 2030, driven by the rising global demand for safe and high-quality food. Consequently, stricter regulations and inspections are being implemented to ensure compliance with food safety standards

- Asia Pacific, led by China, emerged as the dominant regional market in 2023. Its growth is driven by robust economic growth and extensive international trade activities. China’s significant contribution to global trade volumes, coupled with stringent regulatory frameworks, fueled the demand for cargo inspection services in this region, solidifying its industry position

- Established players like SGS Group, Bureau Veritas, and Intertek Group dominate the market. Emerging players offer innovative solutions and cater to niche market segments

Cargo Inspection Market Segmentation

Grand View Research has segmented the global cargo inspection market on the basis of type, offering, inspection phase, end use, and region:

Cargo Inspection Type Outlook (Revenue, USD Million, 2017 - 2030)

- Physical Inspection

- Non-intrusive Inspection (NII)

- Documentation Verification

Cargo Inspection Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Product Inspection

- Container Inspection

- Weighbridge Inspection

Cargo Inspection Phase Outlook (Revenue, USD Million, 2017 - 2030)

- Destination Inspection (DI)

- Pre-shipment Inspection (PSI)

- During-shipment Inspection (DSI)

Cargo Inspection End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Mining

- Oil & Gas

- Chemicals

- Agriculture

- Manufacturing

Cargo Inspection Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Middle East & Africa (MEA)

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia (KSA)

- South Africa

Order a free sample PDF of the Cargo Inspection Market Intelligence Study, published by Grand View Research.