Canada Maintenance Repair and Overhaul Distribution Market Promoting Digital Transformation Strategies

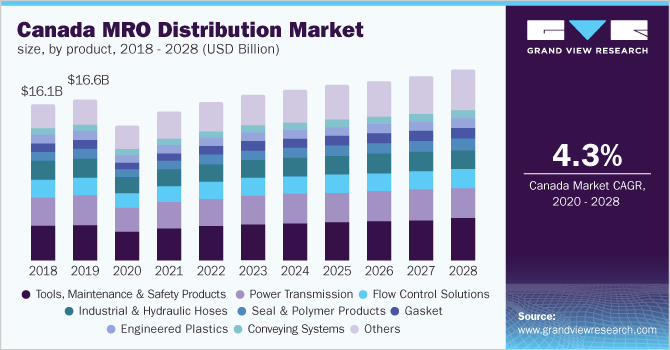

The Canada maintenance, repair & overhaul distribution market size is expected to reach USD 19.10 billion by 2028, registering a CAGR of 4.3% from 2020 to 2028, according to a new report by Grand View Research, Inc. The expanding manufacturing sector in Canada is expected to fuel the growth of the market for maintenance, repair, and overhaul distribution (MRO) over the forecast period.

The growth of the MRO distribution market in Canada is attributed to growth in the manufacturing industries in the country inclusive of food and beverages, aircraft, machinery, transportation, energy and power, electronics, and others for maintenance and repairs of several types of equipment including hoses, gaskets, seals, fasteners, and safety tools.

The adoption of MRO has registered considerable change within the industries, especially with the OEMs considering MRO distribution companies as potential partners to enhance their operational efficiencies and achieve higher profitability. At the same time, the technology and service outsourcing providers have developed specific solutions to address the needs of several end-use industries in Canada.

Gather more insights about the market drivers, restrains and growth of the Canada Maintenance Repair and Overhaul Distribution Market

The major players involved in the MRO products and services distribution in Canada cater to several end-use industries via third-party distributors, annual maintenance contracts, direct sales channels, and e-commerce. In addition, companies tend to collaborate with distributors and retailer companies in different regions for the offering of their services.

Canada Maintenance, Repair & Overhaul Distribution Market Report Highlights

- Aircraft maintenance end use segment is likely to ascend at fastest growth from 2020 to 2028 expanding at a CAGR of 9.2% owing to a robust aircraft maintenance service sector in the country

- MRO distribution for electrical and electronic end use in Canada accounted for 12% in 2020 and is expected to register a CAGR of over 3.9% from 2020 to 2028

- The tools, maintenance, and safety product segment accounted for the revenue of more than USD 2.9 billion in 2020 and is likely to ascend at a notable CAGR in the forthcoming years. Rise in demand for periodic maintenance operations in manufacturing industries in Canada are expected to offer growth prospect

- Power transmission product segment accounted for a revenue share of over 16% in 2020. The adoption of MRO products and services in power transmission, helps to lower down the risk for power outage in case of electrical industry, and proper lifting of products using hydraulic equipment in construction, automobile, and metallurgy industries

- The COVID-19 outbreak in Canada impacted the manufacturing and service industries in 2020. Moreover, suspension of industrial activities across the country has halted the growth of maintenance, repair and overhaul distribution market

Key Companies & Market Share Insights

The MRO distribution market in Canada is highly consolidated owing to the presence of well-established companies. Major companies operating in the region include The Hillman Group, Grainger Canada, Wajax Limited, Applied Industrial Technologies, Wurth Canada, MRC Global, Inc., and SBP Holdings among others.

The major players involved in the MRO products and services distribution in Canada cater to several end-use industries via third-party distributors, annual maintenance contracts, direct sales channels, and e-commerce. In addition, companies tend to collaborate with distributors and retailers companies in different regions for offering their services.

List of Key Players of the Canada Maintenance, Repair & Overhaul (MRO) Distribution Market

- The Hillman Group, Inc

- Eriks North America

- Grainger Canada

- Wajax Limited

- Applied Industrial Technologies

- SBP Holdings

- DGI Supply

- Lawson Products, Inc.

- AWC

- Hisco, Inc.

- EACO Corporation

- BDI Canada

- Wurth Canada

- MRC Global, Inc.

- MSC Industrial Direct Co., Inc.

- Motion Industries, Inc.

- Sun-Source

- Gregg Distributors LP

- GreenLine Hose &Fittings, Ltd.

- R. Thomson Group

- Flex-Pression

- Quest Gasket

- Norwesco Industries Ltd.

- Belterra Corporation

- Midland Industries

Order a free sample PDF of the Canada Maintenance Repair and Overhaul Distribution Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology