Factoring Software Solutions: Grow Your Business

In the present fast-paced and competitive organization setting, companies are regularly looking for approaches to streamline their financial procedures, improve income flow, and minimize administrative overhead. One alternative getting recognition is factoring, an economic support that enables firms to change their receivables in to quick cash. To handle and automate the factoring process effectively, many firms are looking at factoring software. This short article explores factoring computer software, its advantages, characteristics, and how it may increase organization operations.

What is Factoring?

Factoring is an economic layout the place where a organization carries its reports receivable (invoices) to a third party, called an issue, at a discount. In exchange, the business receives quick income, which it may use for detailed needs like paying workers, buying stock, or increasing operations. Once the customer gives the bill, the element takes the payment, minus their fee.

Factoring assists firms with bad or irregular income flow prevent waiting 30 to 90 days for client payments. Alternatively, they can accessibility quick functioning money, which supports keep smooth procedures and growth.

What is Factoring Software?

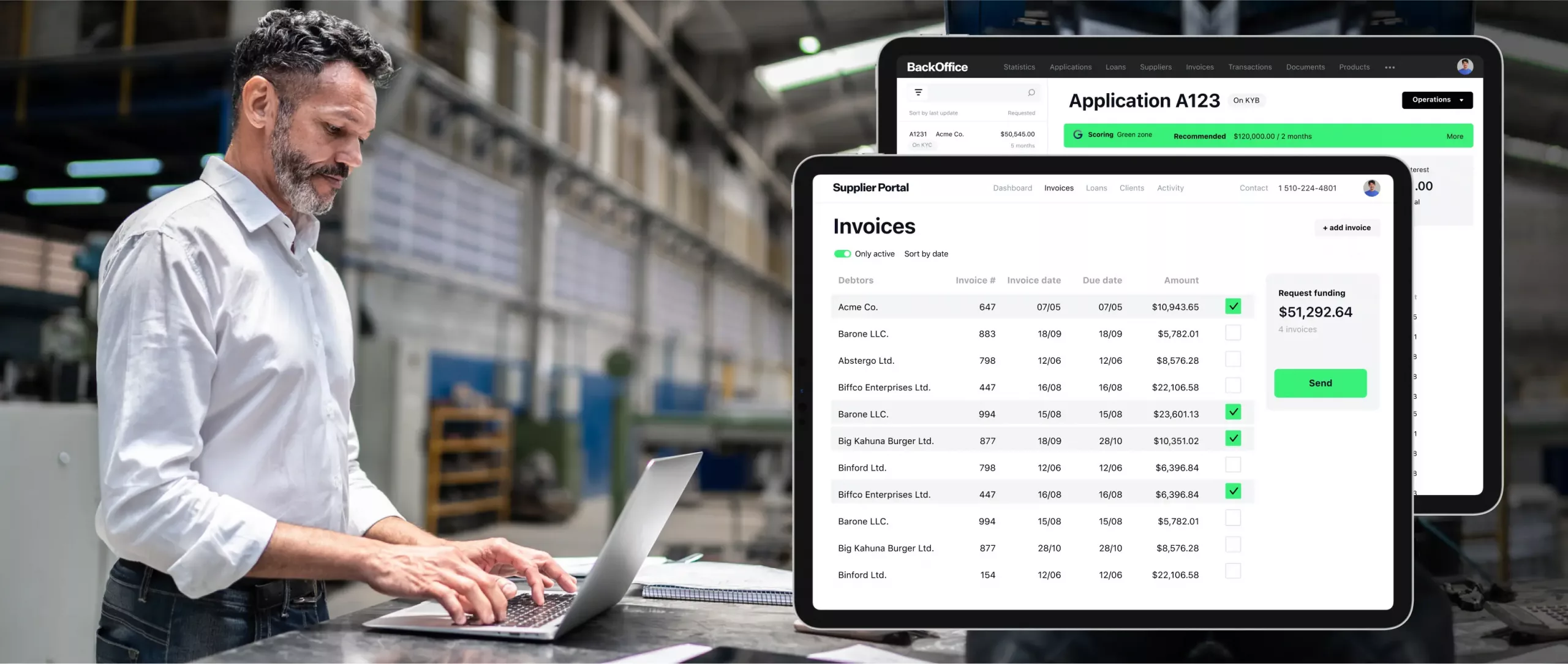

Factoring computer software is a specific software designed to automate and optimize the entire factoring process. It streamlines jobs such as bill administration, payment tracking, chance analysis, and client communication. Factoring computer software generally includes a variety of characteristics that help factoring companies and firms control the buy and number of receivables effectively.

The key aim of factoring computer software is to get rid of manual techniques, minimize the risk of human error, and provide real-time exposure to the position of transactions. By automating factoring, firms may give attention to development rather than getting bogged down by time-consuming administrative tasks.

Features of Factoring Software

-

Account Administration: Factoring computer software simplifies the method of submitting and tracking invoices. It offers an arranged program where firms can quickly publish, keep, and accessibility invoices. The program also enables users to monitor the position of every invoice—whether it has been compensated, is impending, or is overdue—ensuring better exposure of income flow.

-

Real-Time Confirming and Analytics: With factoring computer software, users may make step by step studies and analytics to check the performance of the factoring operations. The program trails crucial metrics like exceptional amounts, ageing studies, client payment trends, and factoring costs, allowing firms to make informed decisions.

-

Automatic Notifications and Pointers: Factoring computer software may send intelligent pointers to clients regarding due payments. That reduces the manual work required to follow along with up on exceptional invoices and promotes income flow management. Additionally, it increases client relationships by providing reasonable and regular communication.

-

Risk Evaluation and Credit Scoring: Many factoring computer software solutions contain integral credit scoring characteristics that measure the creditworthiness of customers. That feature enables factoring companies to analyze chance before buying receivables, ensuring they assist clients who have a high likelihood of paying their bills on time.

-

Account Funding and Disbursement: Factoring computer software assists automate the method of funding invoices. Once an bill is permitted, the device may assess the funding total and disburse income to the business quickly. Some computer software solutions actually provide the option of quick or same-day funding, that is especially important for firms that need quick liquidity.

-

Report Administration: The program permits the storage and administration of applicable documentation linked to factoring transactions. This includes agreements, invoices, client correspondence, and payment records. With file administration characteristics, firms may accessibility all required papers from a central program and minimize paperwork clutter.

-

Customer and Customer Website: Many factoring computer software solutions supply a portal for the factoring company and their clients. That portal enables clients to see the position of the invoices, produce obligations, and speak with the factoring company. That self-service choice reduces the necessity for regular calls or e-mails, keeping time for both parties.

-

Safety and Compliance: Factoring computer software ensures knowledge protection by employing encryption, protected user accessibility controls, and normal backups. Additionally, it assists firms comply with rules linked to knowledge security and financial revealing, such as the Standard Knowledge Security Regulation (GDPR) and anti-money laundering (AML) requirements.

Benefits of Factoring Software

-

Increased Income Flow: Factoring computer software enables firms to obtain faster access to functioning money by simplifying and automating the factoring process. With quicker running instances and successful tracking of receivables, firms may improve their income flow, that is critical for sustaining everyday operations.

-

Time and Charge Savings: By automating jobs like bill tracking, payment pointers, and revealing, factoring computer software reduces the necessity for manual intervention. That results in time and price savings, enabling workers to target on more strategic jobs rather than administrative chores.

-

Greater Risk Administration: With integral credit chance assessments and credit scoring, factoring computer software assists firms minimize the risk of working together with unreliable customers. This assists prevent expensive defaults and bad debts that could usually disturb income flow.

-

Increased Customer Associations: Factoring computer software may improve transmission between firms and their clients by providing regular, automatic improvements on bill status. Customers benefit from reasonable pointers and easy payment choices, that may increase their experience and enhance the business relationship.

-

Structured Procedures: The centralization of factoring procedures in to one program causes it to be easier for firms to control numerous clients, invoices, and transactions at once. The program streamlines the entire factoring process, from funding to payment tracking, ensuring better operations.

-

Greater Decision-Making: The real-time knowledge and analytics offered by factoring computer software provide firms with important insights within their factoring performance. These insights may be used to make better financial decisions, recognize trends, and optimize organization operations.

How Factoring Software Helps Different Types of Businesses

-

Small Organizations: Small firms with confined income flow may significantly benefit from factoring computer software because it enables them to gain access to functioning money quickly. By outsourcing the administrative burden to factoring computer software, they can give attention to development without worrying about overdue invoices.

-

Factoring Organizations: Factoring computer software is particularly helpful for factoring firms that control big sizes of invoices. The program assists them assess client creditworthiness, control numerous clients, and automate the entire factoring process, creating procedures more effective and scalable.

-

Cargo and Logistics Organizations: Cargo factoring is common in the transportation business, where trucking companies usually rely on factoring to boost income flow. Factoring computer software designed to the cargo business may control trucker invoices, help fast obligations, and provide step by step revealing for better decision-making.

-

Company Services: Service-based firms that situation invoices due to their companies, such as marketing agencies, technicians, or IT firms, may also benefit from factoring software. It enables them to quickly element invoices, liberating up money to account constant projects and increase operations.

Conclusion

Factoring computer software is an important software for firms seeking to streamline their factoring techniques and improve their income flow. By automating jobs like bill administration, payment tracking, and client communications, factoring computer software preserves time, reduces human error, and promotes over all efficiency. The benefits are not just restricted to little firms but also increase to factoring companies, support suppliers, and logistics businesses.

The capacity to control receivables, assess credit chance, and gain real-time insights in to financial performance makes factoring computer software a crucial advantage for companies seeking to enhance their financial operations. Whether a small business is seeking to boost its liquidity or streamline procedures, factoring computer software gives the various tools needed to succeed in a competitive marketplace.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology