India Cryptocurrency Market Size, Share, Growth & Forecast 2025-2033

Market Overview 2025-2033

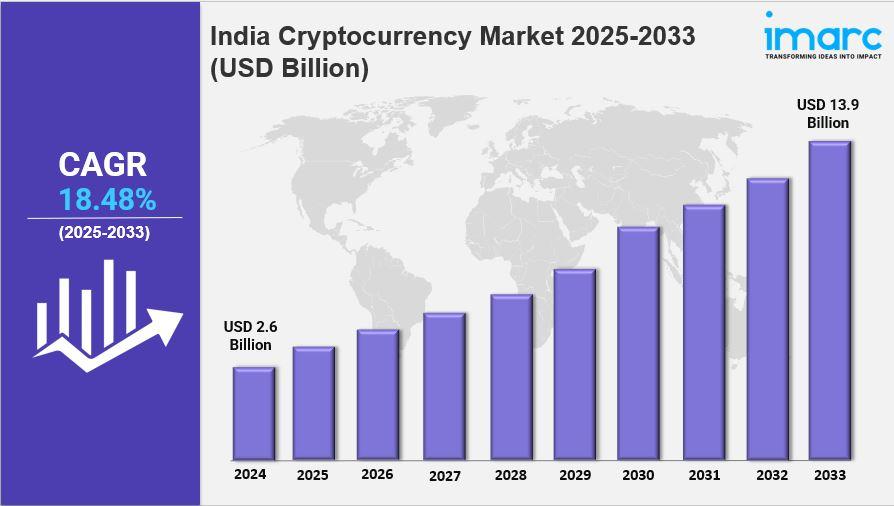

The India cryptocurrency market size was valued at USD 2.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.9 Billion by 2033, exhibiting a CAGR of 18.48% from 2025-2033. The India Cryptocurrency Market is experiencing significant expansion, fueled by growing interest in digital assets, regulatory developments, and technological advancements. Key trends include an increasing number of retail and institutional investors exploring cryptocurrencies as alternative investment options, with many prioritizing security and potential high returns.

Major cryptocurrency exchanges are enhancing their platforms, offering a wider array of coins and user-friendly services to cater to diverse investor preferences. Additionally, the market is witnessing a surge in educational initiatives aimed at improving awareness and understanding of blockchain technology, which is essential for fostering trust and encouraging broader adoption of cryptocurrencies across the nation.

Key Market Highlights:

✔️ Significant growth driven by regulatory clarity and government interest in blockchain technology, alongside rising public awareness about the potential of digital currencies.

✔️ Increasing adoption of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs), which are enhancing the appeal and utility of cryptocurrencies among a broader audience.

✔️ Heightened engagement from major financial institutions and tech companies in developing cryptocurrency products and services, resulting in a wider range of investment options and improved market accessibility.

Request for a sample copy of the report: https://www.imarcgroup.com/india-cryptocurrency-market/requestsample

India Cryptocurrency Market Trends and Driver:

The India Cryptocurrency Market is poised for transformative changes as it continues to evolve rapidly. With increasing regulatory clarity and a supportive government stance, the landscape for digital currencies is becoming more favorable. This shift is encouraging both retail and institutional investors to explore cryptocurrencies as viable investment options. As awareness about blockchain technology and its applications grows, more individuals are likely to engage with cryptocurrencies, driving demand across various sectors.

In 2025, the India Cryptocurrency Market Demand is expected to surge as more people recognize the potential of digital assets. The rise of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) is attracting a diverse audience, from tech-savvy millennials to traditional investors looking for new opportunities. This increasing interest is not only limited to speculative trading; many are beginning to see cryptocurrencies as a hedge against inflation and a means to diversify their investment portfolios.

Moreover, the technological advancements in blockchain infrastructure are set to enhance the user experience significantly. Improved security measures, faster transaction times, and lower fees will make cryptocurrencies more appealing to everyday users. As more businesses begin to accept digital currencies for transactions, the overall acceptance of cryptocurrencies in India will likely increase, further adding to the momentum of the market.

Looking ahead, the India Cryptocurrency Market Growth is anticipated to be robust, driven by innovations in financial products and services tailored for the digital asset space. Major financial institutions are investing in cryptocurrency solutions, providing customers with secure and regulated avenues for trading and investing. This combination of regulatory support, technological advancements, and growing consumer interest will position India as a key player in the global cryptocurrency landscape, making 2025 a pivotal year for the market's development.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=9084&flag=C

India Cryptocurrency Market Segmentation: The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Type:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Analysis by Component:

- Hardware

- Software

Analysis by Process:

- Mining

- Transaction

Analysis by Application:

-

- Trading

- Remittance

- Payment

- Others

Regional Analysis:

- South India

- North India

- West & Central India

- East India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology