India Plastics Market Size, Growth & Trends Report 2025-2033

Market Overview 2025-2033

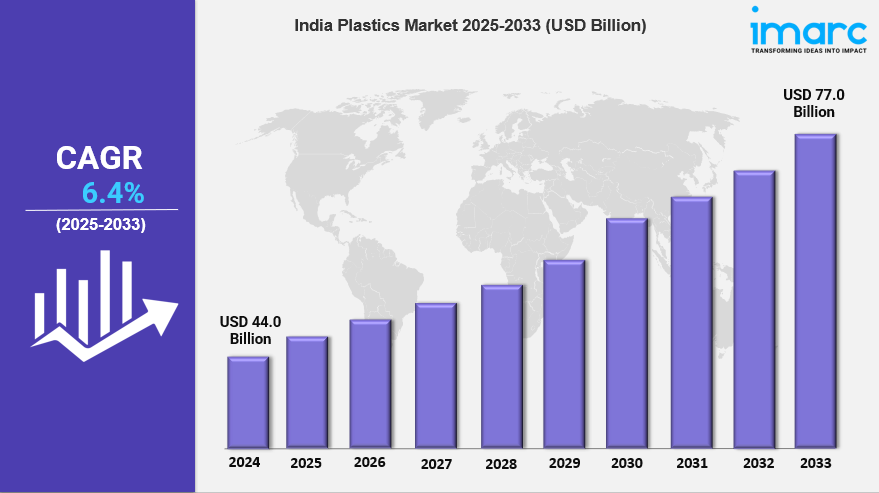

India plastics market size reached USD 44.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 77.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.4% during 2025-2033. The rising innovations, evolving consumer needs, and the material's indispensable role in modern manufacturing and technology are some of the primary factors driving the market growth across the country.

Key Market Highlights:

✔️ Strong expansion driven by industrial growth & rising consumer demand

✔️ Growing preference for biodegradable and recyclable plastics

✔️ Advancements in lightweight, durable, and high-performance materials

✔️ Increased investments in sustainable manufacturing and innovation

Request for a sample copy of the report: https://www.imarcgroup.com/india-plastics-market/requestsample

India Plastics Market Trends and Driver:

The Indian plastics market is undergoing a significant transformation as sustainability becomes a key priority for industries and consumers alike. Government regulations banning single-use plastics and initiatives promoting a circular economy are accelerating this shift. By 2025, companies are making substantial investments in biodegradable plastics, recycled polymers, and bio-based alternatives to minimize environmental impact. The packaging sector, a major consumer of plastics, is driving demand for compostable and reusable packaging solutions, pushing businesses to adopt greener practices.

Industries such as FMCG, e-commerce, and food delivery are increasingly integrating sustainable packaging solutions, further propelling market expansion. Technological advancements have enabled the development of high-performance biodegradable plastics that match the durability and versatility of conventional materials. With rising consumer awareness, businesses are prioritizing closed-loop recycling systems and incorporating post-consumer recycled content into their products. This strong momentum toward sustainability is expected to shape the long-term trajectory of the Indian plastics market.

The growing use of plastics across industries such as automotive, construction, and electronics is also fueling market expansion. Manufacturers are focusing on energy efficiency and cost reduction by replacing traditional materials like metal and glass with lightweight plastic components. By 2025, the automotive industry is set to be a major driver of demand, with electric vehicle (EV) manufacturers increasingly relying on high-performance engineering plastics to improve efficiency and reduce vehicle weight. Similarly, the construction sector is witnessing increased adoption of plastic-based materials like uPVC pipes, insulation panels, and modular components due to their durability and cost-effectiveness.

The electronics industry is benefiting from innovative plastic solutions, with demand rising for flame-retardant and conductive polymers in electronic devices. These advancements in lightweight, high-strength plastics are revolutionizing industrial applications, making them indispensable in modern manufacturing.

India’s rapidly expanding consumer market is further boosting demand for plastics, particularly in packaging and FMCG sectors. The surge in e-commerce, urbanization, and evolving consumer preferences has heightened the need for durable, lightweight, and visually appealing packaging materials. By 2025, the packaging industry will remain the largest consumer of plastics, focusing on innovations that balance sustainability with cost-effectiveness.

Flexible packaging, PET bottles, and multilayer films are gaining popularity, driven by the need for extended shelf life and enhanced convenience. Brands are incorporating smart packaging technologies, such as QR codes and interactive designs, to improve consumer engagement. Additionally, the rising demand for premium and personalized products has intensified the need for high-quality plastic packaging with superior barrier properties. With continued growth in the retail and FMCG sectors, the plastics market is poised for strong expansion, adapting to the evolving needs of both businesses and consumers.

India Plastics Market Segmentation:

We explore the factors propelling the india plastics market growth, including technological advancements, consumer behaviors, and regulatory changes.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Type Insights:

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

Application Insights:

- Injection Molding

- Blow Molding

- Roto Molding

- Compression Molding

- Casting

- Thermoforming

- Extrusion

- Calendering

- Others

End User Insights:

- Packaging

- Automotive

- Infrastructure and Construction

- Consumer Goods

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology