Asia Pacific's Duty-Free Retail Demand: Navigating Growth Amidst Market Challenges

Duty-Free Retailing Market Set for Robust Growth: Regional Insights and Strategic Developments

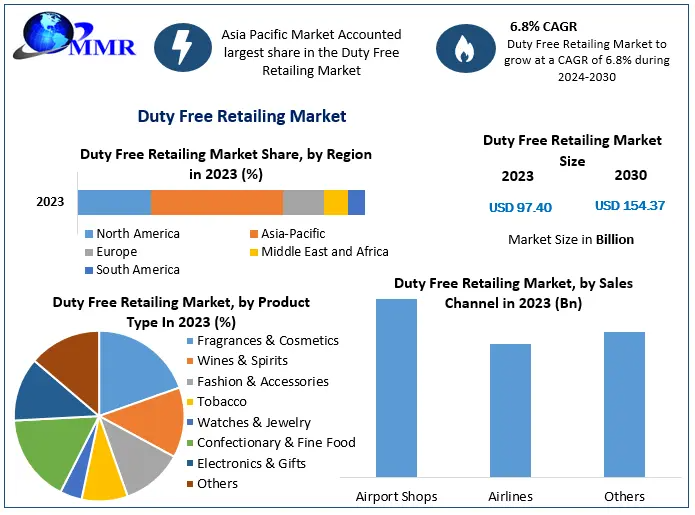

The global Duty-free Retailing Market is experiencing significant expansion, with its size valued at approximately USD 97.40 billion in 2023. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 6.8% from 2024 to 2030, aiming to reach nearly USD 154.37 billion by the end of the forecast period.

Competitive Landscape and Regional Demand

The duty-free retail sector is characterized by intense competition, with key players continually innovating to capture market share. Notably, the Asia Pacific region has emerged as a significant growth area, driven by increasing tourism and a burgeoning middle-class population seeking luxury goods at competitive prices.

Get instant access to your sample copy of this report: https://www.maximizemarketresearch.com/request-sample/145803/

In the United States, the duty-free retail market is experiencing steady growth, propelled by rising international travel and consumer demand for premium products. Major companies are focusing on expanding their presence in key airports. For instance, Avolta, a leading Swiss duty-free retailer, secured a significant contract to manage multiple duty-free, travel convenience, and specialty retail stores at New York's JFK International Airport, marking one of its largest ventures in North America for 2024.

The Asia Pacific region presents substantial opportunities for the duty-free retail industry. Countries like China and South Korea are witnessing increased demand for luxury goods. However, challenges persist; duty-free spending in Hainan, China, decreased by 29.3% in 2024 due to a weak economy and fewer domestic visitors. Shoppers spent 30.94 billion yuan ($4.24 billion) on duty-free goods, down from 43.76 billion yuan in 2023.

The Middle East and Africa region is undergoing significant transformation in the duty-free retail sector. Major players like Dubai Duty Free are expanding their operations, capitalizing on increasing passenger traffic and tourism. The region's strategic location as a travel hub between Europe and Asia positions it well for continued growth in duty-free retailing.

Europe: Duty-Free Retail Trends and Strategic Investments

Europe continues to be a hub for duty-free retail innovation. Avolta reported a 5.7% organic sales growth in the third quarter of 2024, although this fell short of expectations due to weaker performance in the Americas. The company's acquisition of Autogrill has solidified its business model focused on airport retail and food & beverage synergies, with expected synergies reaching 85 million francs in 2024.

Wines & Spirits

Fashion & Accessories

Tobacco

Watches & Jewelry

Confectionary & Fine Food

Electronics & Gifts

Others

by Sales Channel

Airlines

Others

2. LOTTE Duty Free Company

3. DFS Group Limited, Gebr.

4. Heinemann SE & Co. KG,

5. The Shilla Duty Free

6. The King Power International Group

7. James Richardson Corporation Pty Ltd

8. Duty Free Americas, Inc

9. Flemingo International Ltd

10.Dubai Duty Free

11.China Duty Free Group Co., Ltd

12.Others

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology