Faster Payment Service (FPS) Market Dynamics: Key Drivers and Restraints 2022 –2029

The Faster Payment Service (FPS) Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2029. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-faster-payment-service-fps-market

Which are the top companies operating in the Faster Payment Service (FPS) Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Faster Payment Service (FPS) Market report provides the information of the Top Companies in Faster Payment Service (FPS) Market in the market their business strategy, financial situation etc.

ACI Worldwide (U.S.), FIS (U.S.), Fiserv, Inc. (U.S.), wirecard (U.S.), Mastercard (U.S.), Temenos Headquarters SA (U.S.), Global Payments Inc. (U.S.), Capgemini (France), Icon Solutions Ltd (U.K.), M & A Ventures, LLC (U.S.), PAYRIX. (Australia), Nexi Payments SpA (Italy), Obopay (U.S.), Ripple (U.S.), Pelican / ACE Software Solutions Inc. (U.K.), Finastra. (U.K.), Nets A/S (Denmark), Financial Software & Systems Pvt. Ltd. (India), Montran (India), Visa Inc. (U.S.)

Report Scope and Market Segmentation

Which are the driving factors of the Faster Payment Service (FPS) Market?

The driving factors of the Faster Payment Service (FPS) Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Faster Payment Service (FPS) Market - Competitive and Segmentation Analysis:

**Segments**

- **Type**: The FPS market can be segmented into real-time payments, immediate payments, and quick payments. Real-time payments offer instantaneous payment processing, immediate payments ensure funds are settled within a few seconds, and quick payments guarantee fast transaction completion within minutes.

- **Deployment Mode**: The market can also be classified based on deployment mode into cloud-based and on-premises solutions. Cloud-based FPS solutions offer scalability and flexibility, while on-premises solutions provide greater control and customization options for businesses.

- **End-User**: The end-user segmentation includes segments such as banks, financial institutions, e-commerce, retail, and others. Banks and financial institutions are key users of FPS for facilitating quick and secure payments, while e-commerce and retail sectors leverage FPS to enhance customer experience through fast transactions.

**Market Players**

- **Mastercard**: A leading player in the FPS market, Mastercard offers innovative payment solutions and technology to support real-time payments for businesses and consumers globally.

- **Visa Inc.**: Another major player, Visa Inc. provides secure and efficient FPS services to enable seamless payment experiences across different channels and devices.

- **Fidelity National Information Services, Inc. (FIS)**: FIS is a prominent player offering comprehensive FPS solutions to financial institutions and businesses to streamline payment processes and enhance operational efficiency.

- **PayPal Holdings, Inc.**: Known for its digital payment solutions, PayPal offers FPS services that cater to the growing demand for fast and convenient payment options in the digital era.

- **Ant Financial Services Group**: As a key player in the market, Ant Financial Services Group offers diverse FPS solutions through its ecosystem, including Alipay, to support quick and secure payments for businesses and consumers.

The global FPS market is witnessing significant growth due to the increasing adoption of digital payment methods, the rise in online transactions, and the demand for instant payment processing. With advancements in technology and the shift towards cashless economies, the FPSThe FPS market is experiencing substantial growth driven by various factors such as the escalating adoption of digital payment methods, the surge in online transactions, and the need for instant payment processing. One of the key drivers of this market is the rapid digitalization of economies worldwide. As more consumers and businesses transition towards digital payments, the demand for fast and secure FPS solutions continues to rise. The convenience and efficiency offered by FPS in processing transactions in real-time or within seconds are increasingly valued by users across different industries. This shift towards digital payments is further accelerated by the widespread availability of smartphones, internet connectivity, and the growing acceptance of e-commerce platforms.

Furthermore, the increasing emphasis on financial inclusion and the need to cater to the unbanked and underbanked populations are driving the adoption of FPS solutions. These solutions provide a convenient and accessible way for individuals to carry out financial transactions, whether it be sending money to family members, paying bills, or making online purchases. The ability of FPS to facilitate peer-to-peer payments and enable financial transactions without the need for traditional banking infrastructure makes it a vital tool for expanding financial services to underserved communities.

Moreover, the evolving regulatory landscape and the push towards real-time gross settlement systems by central banks worldwide are also contributing to the growth of the FPS market. Regulatory initiatives aimed at enhancing payment infrastructure, ensuring data security, and promoting interoperability among different payment systems are driving the adoption of FPS solutions by financial institutions and businesses. These regulatory mandates are pushing market players to innovate and develop advanced FPS technologies that comply with industry standards and regulatory requirements.

In terms of competition, the FPS market is highly competitive with several key players vying for market share. Companies such as Mastercard, Visa Inc., FIS, PayPal Holdings, Inc., and Ant Financial Services Group are leveraging their technological expertise and global reach to offer innovative FPS solutions tailored to the needs of diverse industries and end-users. These market players are investing in research and development to enhance their product offerings, expand their geographical presence, and forgeThe global FPS market is experiencing robust growth driven by several key factors shaping the digital payment landscape. One of the primary drivers of this market expansion is the increasing consumer preference for convenient and secure payment methods. As more individuals and businesses embrace digital transactions, the demand for real-time and quick payment solutions continues to surge. The instantaneous processing capabilities of FPS solutions cater to the need for efficiency and speed in financial transactions, especially in the fast-paced digital economy.

Moreover, the growing momentum towards financial inclusion and the outreach to underserved populations are propelling the adoption of FPS solutions on a global scale. By providing a reliable and accessible platform for conducting financial transactions, FPS bridges the gap for individuals who lack traditional banking services. This inclusivity aspect not only expands the reach of financial services but also fosters economic empowerment and participation among marginalized communities.

Additionally, regulatory developments and evolving compliance standards are reshaping the FPS market landscape. Central banks and regulatory bodies worldwide are pushing for real-time settlement systems to enhance the overall efficiency and security of payment networks. This regulatory push is prompting FPS providers to enhance their solutions in alignment with the changing regulatory requirements, thereby fostering a more robust and secure payment ecosystem.

Furthermore, the competitive dynamics within the FPS market are intense, with key players such as Mastercard, Visa Inc., FIS, PayPal Holdings, Inc., and Ant Financial Services Group vying for market share. These industry leaders are leveraging their technological prowess and expansive global networks to innovate and deliver cutting-edge FPS solutions that cater to the

Explore Further Details about This Research Faster Payment Service (FPS) Market Report https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market

Key Benefits for Industry Participants and Stakeholders: –

- Industry drivers, trends, restraints, and opportunities are covered in the study.

- Neutral perspective on the Faster Payment Service (FPS) Market scenario

- Recent industry growth and new developments

- Competitive landscape and strategies of key companies

- The Historical, current, and estimated Faster Payment Service (FPS) Market size in terms of value and size

- In-depth, comprehensive analysis and forecasting of the Faster Payment Service (FPS) Market

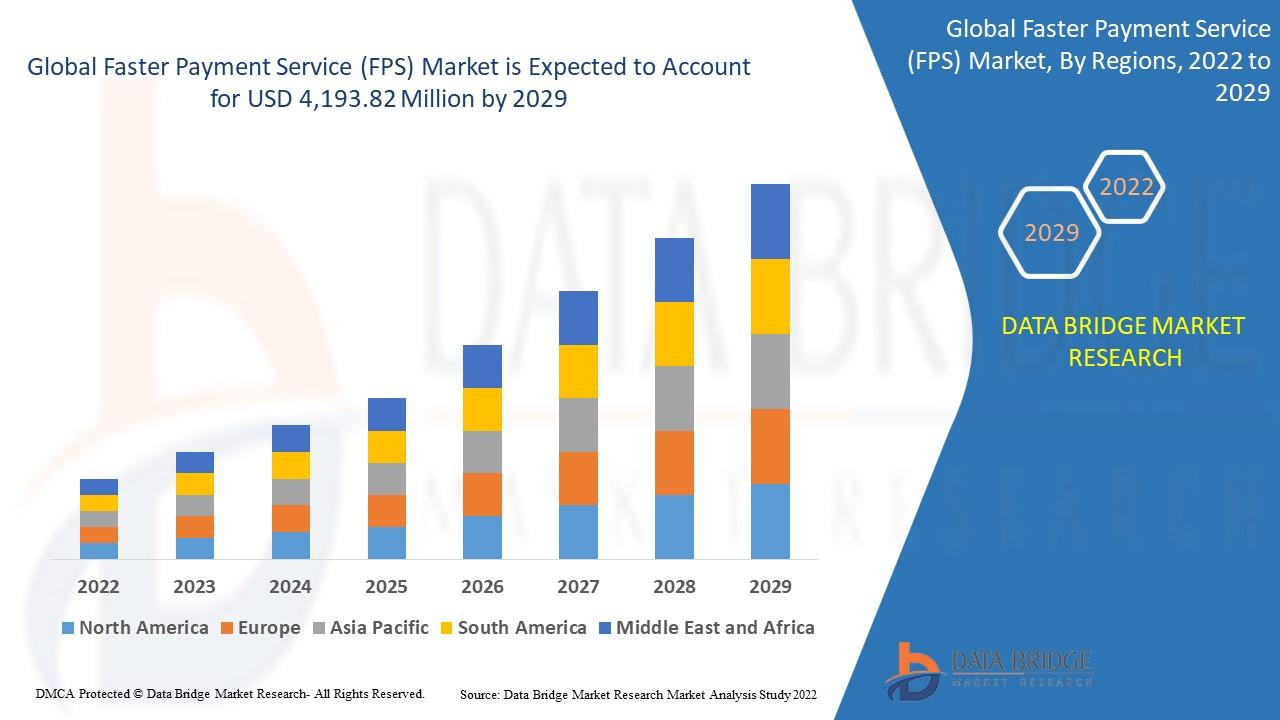

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2029) of the following regions are covered in Chapters

The countries covered in the Faster Payment Service (FPS) Market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of the Middle East and Africa

Detailed TOC of Faster Payment Service (FPS) Market Insights and Forecast to 2029

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: Faster Payment Service (FPS) Market Landscape

Part 05: Pipeline Analysis

Part 06: Faster Payment Service (FPS) Market Sizing

Part 07: Five Forces Analysis

Part 08: Faster Payment Service (FPS) Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: Faster Payment Service (FPS) Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Asia-Pacific Dental Lasers Market – Industry Trends and Forecast

Gynecology Surgical Instruments Market – Industry Trends and Forecast

Industrial X-Ray Market – Industry Trends and Forecast

Surgical Sutures Market – Industry Trends and Forecast

North America Surgical Sutures Market – Industry Trends and Forecast

Europe Surgical Sutures Market – Industry Trends and Forecast

Asia-Pacific Surgical Sutures Market – Industry Trends and Forecast

North America Foam Insulation Market - Industry Trends and Forecast

Europe Foam Insulation Market – Industry Trends and Forecast

Asia-Pacific Foam Insulation Market – Industry Trends and Forecast

U.S. Internal Neuromodulation Devices Market - Industry Trends and Forecast

Belgium Foam Insulation Market – Industry Trends and Forecast

France Foam Insulation Market – Industry Trends and Forecast

North America Industrial X-Ray Market – Industry Trends and Forecast

Europe Industrial X-Ray Market – Industry Trends and Forecast

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 978

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology