Farming for the Future: Regenerative Agriculture Market Insights

As the global food system grapples with the consequences of climate change, biodiversity loss, soil degradation, and declining farm profitability, regenerative agriculture is emerging as a compelling and holistic solution. Unlike conventional and even many sustainable farming practices, regenerative agriculture focuses not just on sustaining—but restoring and enhancing—the health of soil, ecosystems, and communities.

Regenerative agriculture reimagines the agricultural paradigm by prioritizing soil regeneration, carbon sequestration, biodiversity, and resilience to climate extremes. As governments, corporations, investors, and consumers increasingly align around climate-smart strategies, the regenerative agriculture market is gaining momentum globally.

From startups developing microbial soil enhancers to major food brands funding regenerative transitions in their supply chains, the landscape is dynamic, transformative, and rapidly expanding. This article explores the market’s size, growth trends, drivers, challenges, and future outlook through 2033.

Understanding Regenerative Agriculture

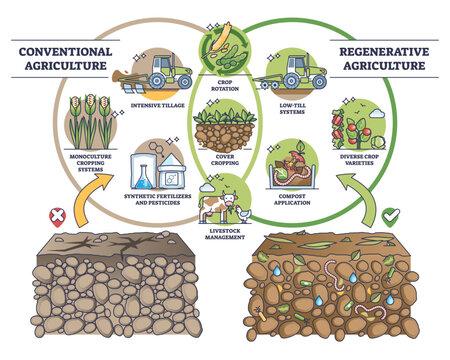

Regenerative agriculture is a system of farming principles and practices that seeks to rehabilitate and enhance the entire ecosystem of the farm. It includes:

- Minimal soil disturbance (no-till or reduced tillage)

- Cover cropping

- Crop rotation and diversification

- Integrated livestock management

- Composting and organic amendments

- Agroforestry and silvopasture

- Holistic grazing

These techniques improve soil structure, boost organic matter, enhance water retention, increase biodiversity, and pull carbon from the atmosphere into the ground, addressing both ecological and economic concerns.

Click Here to Download a Free Sample Report

Market Overview

This growth is driven by:

- Rising demand for climate-resilient and nutrient-dense food

- ESG-driven investments in sustainable agri-practices

- Government incentives for carbon farming

- Increasing soil degradation and desertification concerns

North America and Europe currently lead the market, but Asia-Pacific and Latin America are fast catching up due to shifting consumer preferences and environmental pressures.

Market Drivers

1. Climate Change and Soil Degradation

Over 30% of global land is degraded, affecting food security and climate. Regenerative practices build soil organic carbon and reduce reliance on synthetic inputs, helping to mitigate climate change and restore land fertility.

2. Rise of Carbon Markets

Carbon sequestration through regenerative farming is unlocking new revenue streams for farmers. Voluntary carbon markets and corporate sustainability programs are offering incentives for practices that enhance carbon drawdown.

3. Consumer Demand for Ethical and Nutrient-Dense Food

Today's consumers are more informed and environmentally conscious. Foods grown under regenerative practices are often more nutrient-dense and free from synthetic inputs, aligning with wellness and ethical consumption trends.

4. Corporate Commitments and ESG Goals

Major food companies (e.g., General Mills, Nestlé, Danone, Unilever) have committed to sourcing ingredients from regenerative farms. These brands are offering premiums, technical assistance, and long-term contracts to partner growers.

5. Supportive Policy and Incentive Programs

Governments and NGOs are rolling out subsidy programs, research grants, and technical training. Initiatives such as the EU Green Deal and USDA's Climate-Smart Commodities program are catalyzing regional adoption.

Key Market Segments

By Practice

- Cover Cropping

- Reduced or No-Till Farming

- Composting and Organic Amendments

- Crop Diversification and Rotation

- Agroforestry

- Holistic Grazing

Cover cropping and no-till practices dominate the global acreage under regenerative agriculture due to their scalability and immediate soil health benefits.

By Input Type

- Biologicals (biofertilizers, biostimulants)

- Organic Fertilizers and Soil Amendments

- Compost and Vermicompost

- Mulch and Cover Crop Seeds

- Animal Integration Systems (feed, fencing, mobile pens)

The biological input segment is growing fastest, driven by demand for microbial formulations that enhance nutrient cycling, root growth, and drought resilience.

By End User

- Large-Scale Commercial Farms

- Smallholder and Family Farms

- Agri-tech Startups and Cooperatives

- Corporate Food Supply Chains

- Carbon Credit Developers and Environmental NGOs

Large-scale farms in North America and Australia are embracing regenerative systems for long-term cost savings and environmental compliance. Meanwhile, smallholders in Africa and Asia are incorporating regenerative methods for food security and climate adaptation.

By Crop Type

- Cereals & Grains (wheat, corn, rice)

- Fruits & Vegetables

- Oilseeds & Pulses

- Specialty Crops (coffee, cocoa, wine grapes)

- Pasturelands & Rangelands

Cereals and rangelands form the largest market share, while specialty crops are fast adopters due to export premiums and certification benefits.

Regional Insights

North America

The U.S. and Canada lead the market due to strong institutional support, growing carbon market infrastructure, and pressure from food corporations. Companies like General Mills and PepsiCo are investing in regenerative wheat, oats, and dairy supply chains.

Europe

Europe is home to pioneering regenerative farms and policies. Countries like France, Germany, and the Netherlands have ambitious soil health strategies, and the EU’s Green Deal supports organic and regenerative practices.

Asia-Pacific

Emerging economies such as India, China, and Indonesia are adapting regenerative principles to smallholder farming. Organizations like ICRISAT and FAO are spearheading regional knowledge hubs and pilot projects.

Latin America

Countries like Brazil, Peru, and Colombia are advancing agroforestry, silvopasture, and carbon farming. Regenerative cacao, coffee, and banana farming is expanding due to global sourcing programs.

Africa

African nations are embracing regenerative systems to reverse desertification and improve food security. The Great Green Wall Initiative and support from NGOs have led to success in Kenya, Ethiopia, and Niger.

Technological Integration

1. Soil Monitoring and Diagnostics

IoT-based sensors and lab-free test kits help farmers monitor soil health indicators like microbial biomass, carbon levels, and nutrient cycles in real-time.

2. Satellite and Drone Imaging

Remote sensing supports baselining, verification, and monitoring of regenerative practices, enabling accurate reporting for certification and carbon offset verification.

3. Digital Platforms and Marketplaces

Agri-tech startups are creating platforms for:

- Farmer training and education

- Peer-to-peer marketplaces for compost, cover crop seeds, and bio-inputs

- Integration with carbon credit verification protocols (e.g., Verra, Gold Standard)

4. AI and Predictive Modeling

AI models help optimize regenerative decisions by simulating crop rotations, moisture management, pest risks, and long-term yield forecasts.

Certification and Labeling

Emerging standards help build trust with consumers and enable traceability:

- Regenerative Organic Certification (ROC)

- Land to Market Verified

- Fair Trade + Regenerative

- Demeter (biodynamic)

- Savory Institute’s Ecological Outcome Verification (EOV)

Retailers and food brands are increasingly adopting these labels to capture premium market segments.

Challenges and Constraints

1. Lack of Standardization

Regenerative agriculture lacks a universally accepted definition. Diverse interpretations make it hard to certify, track, and scale practices globally.

2. Transition Costs and Yield Risks

The initial 2–3 years of transitioning can bring yield fluctuations and require upfront investments in training, equipment, and inputs—especially challenging for smallholders.

3. Knowledge and Training Gaps

Scaling regenerative systems requires intensive knowledge transfer and a shift in mindset from conventional, yield-maximization models to systems thinking.

4. Measurement and Verification Complexity

Quantifying carbon sequestration and ecological benefits remains complex. Verification protocols are evolving but can be expensive and time-consuming.

Key Market Players and Innovators

Agribusiness and Input Companies

- Corteva Agriscience

- Syngenta

- BASF

- UPL Ltd.

- Mosaic Biosciences

- Pivot Bio

Food & Beverage Brands Driving Adoption

- General Mills – Pledged to advance regenerative agriculture on 1 million acres.

- Danone – Partnering with dairy farmers to improve soil and pasture health.

- Nestlé – Investing $1.3 billion in regenerative practices across supply chains.

- PepsiCo – Targeting 7 million regenerative acres by 2030.

Regenerative Ag Startups

- Indigo Ag – Carbon credits and agronomy platform

- Regrow Ag – MRV software for sustainability and carbon

- Agreena – European carbon marketplace

- Biome Makers – Soil intelligence through microbiome analytics

Opportunities and Future Outlook

1. Carbon Credit Monetization

Farmers can monetize soil carbon sequestration through carbon offsets, creating additional income and driving adoption. Carbon price trends will directly impact market scale.

2. Rise of Climate-Smart and Resilient Agriculture

With global climate risks mounting, regenerative systems offer drought resilience, pest resistance, and adaptive capacity—making them central to climate-smart agriculture strategies.

3. Institutional Funding and Public-Private Partnerships

Increased flow of capital from impact investors, development banks, and sovereign funds is accelerating the commercialization of regenerative technologies.

4. Synergy with Organic, Permaculture, and Agroecology Movements

Regenerative practices overlap with broader sustainable agriculture philosophies, opening up collaborative frameworks for research, training, and certification.

Conclusion

The regenerative agriculture market represents a paradigm shift—one that places soil health, farmer prosperity, and ecosystem restoration at the center of agricultural development. No longer confined to niche experiments, regenerative systems are being scaled globally with the support of technology, corporate leadership, and policy frameworks.

As stakeholders across the value chain seek climate resilience, ethical sourcing, and long-term profitability, regenerative agriculture offers not just a farming system—but a new way of thinking about food, land, and future.

The road ahead may be complex, but the market potential is enormous. The next decade will determine whether regenerative agriculture remains a promising ideal or becomes the new global standard.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology