The global livestock monitoring market size was estimated at USD 4.01 billion in 2023 and is anticipated to grow at a CAGR of 11.56% from 2024 to 2030. Key factors expected to drive the market include technological advancements, rising support initiatives, increasing focus on preventive livestock monitoring and increasing dairy & meat consumption. The primary driver for this market is the growing technological advancements in the field of livestock monitoring. These advancements are in various forms like hands-free monitoring, automated technologies, penetration of Artificial Intelligence (AI), and implementation of novel technologies including drones, to name a few. For instance, in April 2023, Advantech Co. Ltd. launched a system that uses AI for early monitoring and detection of health complications in livestock. This system uses artificial intelligence (AI) and infrared vision to measure each cow's body temperature.

The system provides access to veterinary professionals and delivers daily scanning of farm animals along with comprehensive findings. It enhances the lives of farmers and their livestock as well as the general food security of their communities, with the potential for future expansion to identify growth, feeding, and environmental conditions.

Gather more insights about the market drivers, restrains and growth of the Global Livestock Monitoring Market

Furthermore, in February 2024, the Universitat Autònoma de Barcelona (UAB) with funding from the EU, developed a platform called ClearFarm. It monitors a wide range of factors related to the behavior of the animals, their physical and mental health, their impact on the environment, and their productivity through various sensors installed throughout the farms and on the animals. The platform gathers these data and employs an algorithm to provide precise, audience-specific information on animal welfare. On one hand, a website gives farmers access to up-to-date information on the health of the animals, with an emphasis on indicators of danger that can help them anticipate issues and implement solutions. However, customers can also find out about the health background of the animal product that they buy by scanning a QR code on the packaging, for instance, which will take them to a website featuring this data.

Animal Insights

The bovine segment held the largest revenue share of 51.2% in 2023 and anticipated to witness the highest growth rate over the forecast period. Increased demand for livestock monitoring solution is largely due to rising consumption of beef and dairy products. To guarantee safety and stop the spread of disease, these dairy and beef products must be of the highest caliber, and as a result, they are constantly inspected by a number of public and private organizations. Additionally, the use of livestock monitors for disease prevention has increased due to consumers' and farmers' growing awareness, which is contributing to the segment's growth.

Solution Insights

The hardware segment dominated the market with a share of 42.7% in 2023. Sensors, GPS/RFIDs, and other hardware solutions are the sub-segments of the hardware segment. Many countries around the globe depend on animals like sheep, cattle, and buffalo for economic purposes, which makes it critical for farmers to implement efficient and effective methods to increase animal productivity and lower the rate of animal disease. This is the segment's primary driving force. The fact that hardware solutions don't harm animals, or the environment makes them appealing to many farmers who raise livestock. Products like GPS/RFIDs are least invasive but most effective in monitoring the whole livestock on a farm. It is expected that utilization of hardware will increase farming productivity and lessen farmer difficulties, increasing output, further driving the segment.

Application Insights

The milking management segment dominated the market with a share of over 24.3% in 2023. Its crucial role in dairy revenue and productivity gains accounts for its dominance. Technological developments in data analytics and automated milking systems improve farm management and monitoring effectiveness. Through early identification of issues and stress reduction, these systems enhance animal health. They also save labor costs and connect traceability and quality standards requirements. Their adoption is further fueled by the growing consumer demand for premium dairy products and the scalability of these solutions, which provide a substantial return on investment.

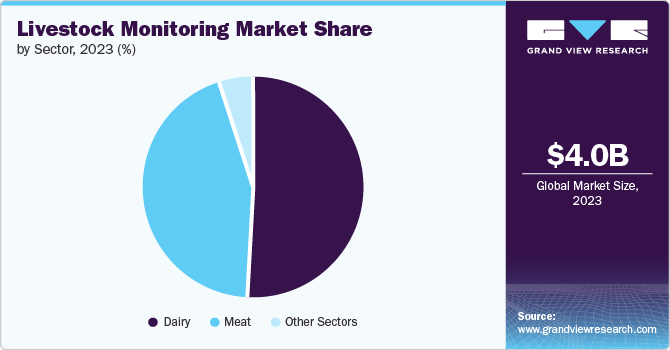

Sector Insights

The dairy segment dominated the market in 2023 and is expected to grow at a CAGR of 11.36% over the forecast period. The dairy sector is dominated by countries like India and China, among others. These countries are the leading producers of milk and have the largest bovine population in the world. These factors result in the adoption of various advanced technologies in ensuring that the dairy production does not get affected due to health complications. Authorities in these countries are involved in collaborating with global experts to ensure effective monitoring and treatment practices are used for the livestock population. Furthermore, the segment is also driven by the large scale consumption of dairy products like milk, cheese, and others. For example, according to 2023 data by FAO, between the period 1992 to 2022 the production of milk has increased by about 77% owing the high demand.

Browse through Grand View Research's Healthcare Industry Research Reports.

- Hyperlipidemia Drugs Market: The global hyperlipidemia drugs market size was valued at USD 23.1 billion in 2023 and is projected to grow at a CAGR of 2.8% from 2024 to 2030.

- Cystic Fibrosis Therapeutics Market: The global cystic fibrosis therapeutics market size was valued at USD 10.3 billion in 2024 and is anticipated to grow at a CAGR of 14.2% from 2025 to 2030.

Regional Insights

North America market dominated the global market with a share of 28.5% in 2023 due to the increased demand for technology to monitor sick animals due to the prevalence of zoonotic diseases. With 18.0% of the world's production in 2023, the United States is the world's top producer of bovine meat, according to data released by National Beef Wire in June 2024. This is the factor that motivates the need to stop foodborne and zoonotic illnesses linked to livestock animals. Furthermore, the market is expanding due to the steady advancements in sensor technology.

Key Livestock Monitoring Company Insights

Companies in this industry are actively involved in bringing in novel technologies into the livestock monitoring industry. They are engaged in launching novel and enhanced solutions to disrupt the market by providing better alternatives to the existing products. Industry players are also forming crucial alliances with other players to either develop innovative technologies or enhance their existing products with an aim of dominating in the market.

Key Livestock Monitoring Companies:

The following are the leading companies in the livestock monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Afimilk Ltd.

- DeLaval

- BouMatic

- Merck & Co., Inc. (Allflex)

- Zoetis

- Lely

- Moocall

- GEA Group Aktiengesellschaft

- Fullwood Packo

- Dairymaster

- Fancom BV

- Nysbys

- PsiBorg Technologies Pvt. Ltd

- Boehringer Ingelheim

Order a free sample PDF of the Livestock Monitoring Market Intelligence Study, published by Grand View Research.