Vietnam Health Insurance Market Overview

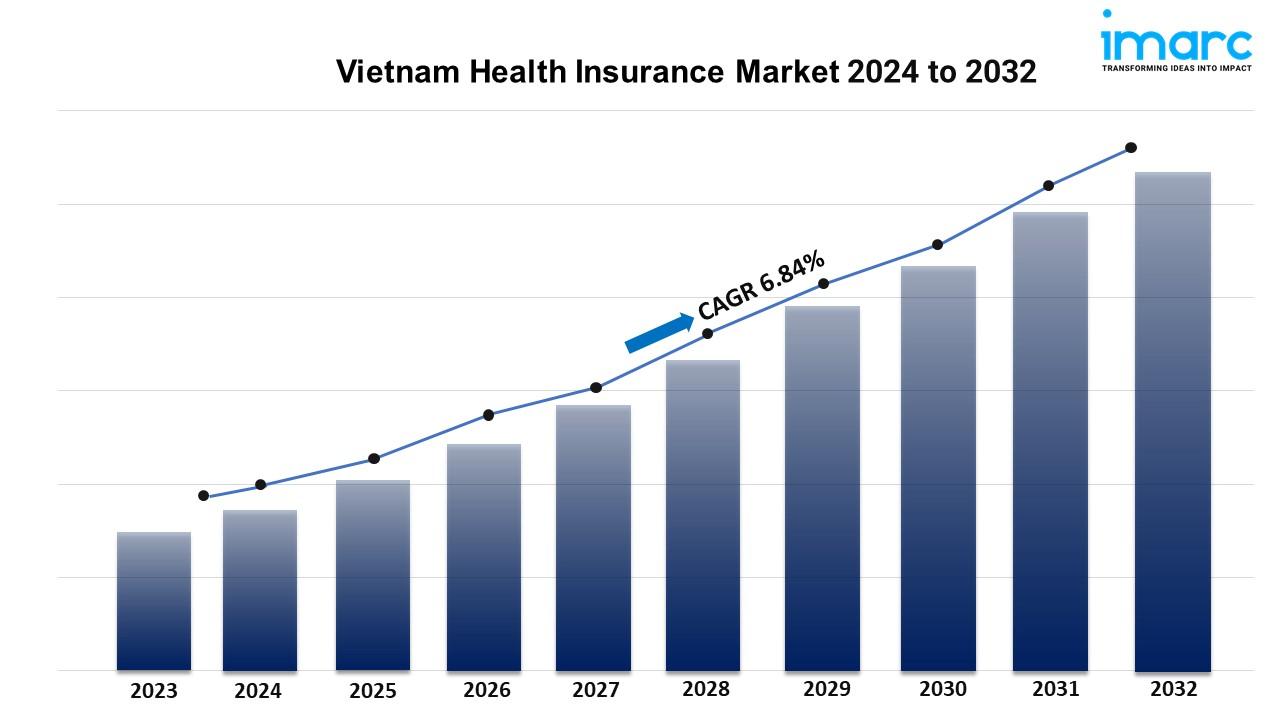

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 6.84% (2024-2032)

The Vietnam health insurance market is growing rapidly, fueled by rising healthcare awareness, increasing disposable incomes, and supportive government policies. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 6.84% from 2024 to 2032.

Vietnam Health Insurance Market Trends and Drivers:

The Vietnam health insurance market is witnessing rising healthcare awareness and increasing demand for comprehensive medical coverage. With an expanding middle class and a growing recognition of the financial security health insurance offers, more individuals are seeking policies that cater to their needs. Additionally, Vietnam’s aging population is amplifying the demand for health services, driving interest in insurance products that provide long-term healthcare solutions. This trend is further encouraged by government initiatives aimed at expanding universal healthcare access, which includes promoting private-sector participation to alleviate the burden on public health systems.

Digital advancements are also playing a critical role as insurers leverage technology to offer more accessible and user-friendly policies, simplifying claims processes and improving customer engagement. The rise of digital health solutions, such as telemedicine and online consultations, complements these efforts, making healthcare more efficient and readily available across urban and rural areas.

Vietnam's health insurance market is driven by economic growth, urbanization, and an evolving healthcare landscape. Rapid economic development has led to increased disposable incomes, making health insurance more affordable for a broader section of the population. With urbanization accelerating, more people are gaining exposure to healthcare benefits, leading to greater demand for insurance options that cover diverse medical needs. Government policies are also significantly impacting the market, as authorities aim to achieve universal health coverage by encouraging the private sector to invest in health insurance, complementing public health initiatives. Furthermore, Vietnam’s aging population necessitates more extensive healthcare coverage, with older adults seeking policies that provide long-term care and cover critical illnesses.

The influence of technology is another factor reshaping the market. Insurers are embracing digital platforms to reach a broader audience, particularly in rural areas, where traditional access to healthcare and insurance services remains limited. These platforms simplify the policy purchasing process and streamline claims, improving customer satisfaction. Telemedicine and online health consultations are becoming popular, making healthcare more accessible and affordable, especially for those in remote locations. Finally, changing consumer expectations, particularly among younger, tech-savvy individuals, are driving insurers to innovate, creating flexible policies that cater to modern lifestyles and preferences. This shift reflects the broader digital transformation within Vietnam’s healthcare sector, making health insurance a more attractive and viable option for many Vietnamese consumers.

Vietnam Health Insurance Market 2024-2032 Analysis and Segmentation:

The report provides an analysis of the key trends in each segment of the Vietnam health insurance market size, along with forecasts at the country level for 2024-2032. Our report has categorized the market based on product and end-use industry.

Type of Insurance Provider Insights:

- Public

- Private

Type of Coverage Insights:

- Individual

- Family

Mode of Purchase Insights:

- Insurance Companies

- Insurance Agents/Brokers

- Others

Premium Type Insights:

- Regular Premium

- Single Premium

End User Insights:

- Minors

- Adults

- Senior Citizens

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/vietnam-health-insurance-market/requestsample

Key highlights of the report:

- Market Performance (2018-2023)

- Market Outlook (2024- 2032)

- Porter’s Five Forces Analysis

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain

- Comprehensive Mapping of the Competitive Landscape

If you need specific information not currently within the report's scope, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high-technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence through research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145